If you’ve ever looked at a chart of a financial asset, you’ve probably noticed some lines that seem to follow the price movement. These lines are called support and resistance levels and they are important indicators that traders use to make decisions on buying and selling assets. Understanding these levels can be a daunting task for beginners, but once you get a hold of it, these patterns can be an incredibly useful tool in your trading arsenal.

In this beginner’s guide, we will demystify support and resistance levels and show you how to use them to your advantage. We’ll cover everything from what they are and how they form to how to identify them on a chart and how to use them in your trading strategy. So whether you’re new to trading or just looking to expand your knowledge, read on to learn how to use support and resistance levels to make more informed trading decisions.

1. Introduction to support and resistance levels in chart patterns

When it comes to analyzing price movements in financial markets, support and resistance levels play a crucial role. These levels are key elements of technical analysis and can provide valuable insights into market trends and potential future price movements. In this beginner’s guide to chart patterns, we will demystify the concept of support and resistance levels and help you understand their significance in trading.

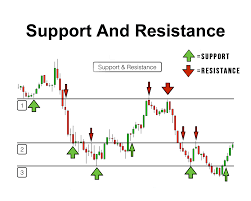

Support levels are price levels at which buying pressure is strong enough to prevent the price from falling further. It acts as a floor for the price, where demand surpasses supply, causing the price to bounce back up. Traders often watch for support levels to identify potential buying opportunities or to set stop-loss orders to limit their downside risk.

On the other hand, resistance levels are price levels at which selling pressure becomes dominant, preventing the price from rising further. It acts as a ceiling for the price, where supply exceeds demand, causing the price to reverse its upward momentum. Traders closely monitor resistance levels to spot potential selling opportunities or to set profit-taking levels.

Understanding support and resistance levels is essential as they can help traders make informed decisions based on historical price patterns. By identifying these levels on a chart, traders can anticipate potential price reactions, such as breakouts or reversals, and adjust their trading strategies accordingly.

In this guide, we will explore various chart patterns that involve support and resistance levels, such as trend lines, and channels, and chart formations like double tops and bottoms. By learning to recognize these patterns and understanding their implications, you will gain a solid foundation for technical analysis and improve your trading skills.

So, let’s dive into the world of support and resistance levels in chart patterns and unravel the secrets behind these powerful tools that can help you navigate the financial markets with confidence.

2. Understanding the basics: What are support and resistance levels?

Support and resistance levels are fundamental concepts in technical analysis that help traders make informed decisions in the financial markets. These levels are key price levels that tend to act as barriers, either preventing the price from moving lower (support) or higher (resistance). By understanding and identifying these levels, traders can gain valuable insights into market trends and potential future price movements.

Support levels are price levels where demand for an asset is strong enough to prevent the price from falling further. Think of it as a floor that provides a foundation for the price. When the price approaches a support level, buyers are more likely to step in and purchase the asset, creating upward pressure and potentially leading to a price rebound. Traders often look for multiple instances where the price has bounced off a support level, as this strengthens the level’s significance and reliability.

On the other hand, resistance levels are price levels where supply outweighs demand, preventing the price from rising further. Visualize it as a ceiling that restricts the price from moving upward. When the price nears a resistance level, sellers tend to be more active, creating selling pressure and potentially causing a price reversal or consolidation. Similar to support levels, traders seek multiple instances of the price failing to break above a resistance level to confirm its validity.

Support and resistance levels can be identified through various methods, including analyzing historical price data, using technical indicators, or drawing trendlines on a chart. These levels are not fixed and can change over time as market dynamics shift. It is essential for traders to regularly monitor and update their support and resistance levels to adapt to changing market conditions.

Understanding support and resistance levels is a crucial step for any beginner trader. These levels provide valuable insights into market sentiment, potential price reversals, and areas of interest for both buying and selling. By incorporating support and resistance analysis into their trading strategies, beginners can enhance their decision-making process and increase their chances of successful trades.

3. Identifying support levels: How to spot areas of buying pressure

Identifying support levels is essential in understanding chart patterns and predicting future price movements. These levels indicate areas of buying pressure, where demand for an asset outweighs supply, leading to a potential reversal or a temporary halt in the downward price trend.

One of the key tools to identify support levels is trendlines. By connecting the swing lows or bottoms on a price chart, you can create a trendline that acts as a visual guide to potential support areas. When the price approaches this trendline, it often encounters buying interest, preventing further decline.

Another method to identify support levels is through horizontal lines. These lines are drawn at price levels where the asset has historically shown strong buying interest, causing the price to bounce back or consolidate. Traders look for price reactions at these levels, such as previous lows, consolidation zones, or areas of high trading volume.

Additionally, technical indicators can help confirm support levels. For example, the moving average, a widely used indicator, can act as dynamic support. When the price approaches or touches the moving average, it can serve as a support level, especially if it aligns with other technical factors or chart patterns.

Moreover, candlestick patterns can provide insights into areas of buying pressure. Look for bullish reversal patterns, such as hammer, engulfing, or morning star patterns, forming near specific price levels. These patterns suggest that buyers have stepped in, creating support and potentially leading to a trend reversal.

Remember that support levels are not definitive and can be breached in volatile market conditions. It is essential to consider other technical factors, fundamental analysis, and market sentiment in conjunction with support levels to make informed trading decisions.

By mastering the art of identifying support levels, you can gain a deeper understanding of chart patterns and improve your ability to anticipate potential price movements, empowering you as a beginner trader in the exciting world of financial markets.

4. Recognizing resistance levels: Identifying areas of selling pressure

When it comes to analyzing stock charts, one key aspect that traders and investors often focus on is identifying areas of selling pressure, also known as resistance levels. These levels indicate a point at which the price of an asset tends to face significant selling pressure, preventing it from moving higher.

Resistance levels can be identified in several ways. One common method is by looking for previous price peaks or highs on the chart. These peaks represent levels at which the price has previously struggled to break through, suggesting the presence of selling pressure. Traders often draw horizontal lines connecting these highs to visualize the resistance level.

Another approach to identifying resistance levels is by using technical indicators such as moving averages or trend lines. These indicators can help smooth out price fluctuations and provide a clearer picture of where resistance may occur. For instance, a downward-sloping trend line connecting multiple lower highs can indicate a strong resistance level.

Additionally, traders often pay attention to volume levels when identifying areas of selling pressure. Higher volumes during price peaks suggest increased selling activity, reinforcing the significance of the resistance level.

Once a resistance level is identified, it can serve as a valuable tool for traders. It provides a reference point to set profit targets or to place stop-loss orders to manage risk. If the price manages to break through a resistance level, it may indicate a bullish signal, potentially leading to further price appreciation.

However, it is important to note that resistance levels are not foolproof indicators, and they can be broken. Market conditions, news events, and other factors can influence price movements and override the selling pressure at a particular level. Therefore, it is crucial to combine the identification of resistance levels with other technical analysis tools and fundamental analysis to make informed trading decisions.

By learning to recognize areas of selling pressure on a chart, beginner traders can gain a deeper understanding of market dynamics and improve their ability to identify potential trading opportunities.

5. The psychology behind support and resistance levels

Understanding the psychology behind support and resistance levels is crucial for any beginner looking to navigate the world of chart patterns. These levels are not just arbitrary lines on a chart; they represent the collective sentiment and behavior of market participants.

Support levels are areas where buying pressure is strong enough to prevent the price from falling further. Imagine a stock price that has been declining for some time but suddenly bounces back every time it reaches a certain price. This is a clear indication that there is significant demand at that level, as investors see it as an attractive buying opportunity. From a psychological standpoint, support levels can be seen as a point of reassurance for buyers, as they believe that the price will not drop below that level.

On the other hand, resistance levels are areas where selling pressure becomes dominant, preventing the price from rising further. Visualize a stock price that repeatedly fails to break through a certain level, despite numerous attempts. This suggests that there is strong supply at that level, as sellers are willing to offload their shares whenever the price reaches that point. Psychologically, resistance levels can be viewed as a point of hesitation for sellers, as they believe that the price will struggle to surpass that level.

Understanding the psychology behind support and resistance levels allows traders to anticipate market movements with more accuracy. When a stock price approaches a support level, buyers may become more confident and start accumulating shares, potentially leading to a price reversal. Conversely, when a stock price nears a resistance level, sellers may become more active, leading to a potential price decline.

Moreover, support and resistance levels can also serve as important decision-making points for traders. Breakouts above resistance levels or breakdowns below support levels can be significant signals, indicating a shift in market sentiment and potentially offering lucrative trading opportunities.

By comprehending the psychology behind support and resistance levels, beginners can gain valuable insights into market dynamics and make more informed trading decisions. Remember, these levels are not just lines on a chart; they represent the collective emotions, beliefs, and actions of market participants, providing valuable clues about future price movements.

6. Common chart patterns associated with support and resistance levels

Understanding common chart patterns associated with support and resistance levels is crucial for any beginner looking to navigate the world of technical analysis. These patterns can provide valuable insights into market trends and potential price reversals, helping traders make more informed decisions.

One common pattern is the double top or double bottom. A double top occurs when the price reaches a certain level, reverses, and then makes another attempt to reach that level again, only to fail and reverse once more. This pattern indicates a potential resistance level, where sellers are consistently entering the market and preventing further upward movement. On the other hand, a double bottom is the opposite, indicating a potential support level where buyers are stepping in and preventing further downward movement.

Another pattern to watch out for is the head and shoulders pattern. This pattern consists of three peaks, with the middle peak being the highest (the head) and the other two (the shoulders) being slightly lower. The neckline, which connects the lows between the peaks, acts as a support level. Once the price breaks below the neckline, it signals a potential reversal and a shift from an uptrend to a downtrend.

Additionally, the ascending triangle and descending triangle patterns are worth noting. An ascending triangle is formed by a horizontal resistance level and an upward-sloping trendline acting as support. This pattern suggests a potential breakout to the upside. Conversely, a descending triangle has a horizontal support level and a downward-sloping trendline acting as resistance. This pattern indicates a potential breakdown to the downside.

Lastly, the symmetrical triangle is a pattern characterized by converging trendlines, forming a triangle shape. This pattern indicates a potential continuation of the current trend, as the market consolidates and prepares for a breakout in either direction.

By familiarizing yourself with these common chart patterns associated with support and resistance levels, you can start to identify potential trading opportunities and make more informed decisions. Remember, practice and careful analysis are key to mastering technical analysis and maximizing your chances of success in the market.

7. Technical analysis tools for confirming support and resistance levels

When it comes to identifying and confirming support and resistance levels, there are several technical analysis tools that can be incredibly helpful. These tools provide valuable insights into the market trends and help traders make more informed decisions.

One widely used tool is trend lines. Trend lines are drawn on a price chart to connect consecutive highs or lows. An upward sloping trend line can act as a support level, while a downward sloping trend line can act as a resistance level. When a price approaches these trend lines, traders pay close attention as they can indicate potential reversals or breakouts.

Another useful tool is moving averages. Moving averages calculate the average price over a specified period and create a line on the chart. The most commonly used moving averages are the 50-day and 200-day moving averages. These moving averages can act as dynamic support or resistance levels, especially when the price approaches them.

Additionally, traders often rely on oscillators, such as the relative strength index (RSI) or stochastic oscillator, to confirm support and resistance levels. These indicators measure the strength and momentum of price movements, helping traders identify overbought or oversold conditions. When the price reaches extreme levels indicated by these oscillators, it can suggest a potential reversal or continuation of the trend.

Furthermore, Fibonacci retracement levels are frequently employed to identify support and resistance levels. These levels are calculated based on specific ratios derived from the Fibonacci sequence. Traders use these retracement levels to anticipate potential price reversals or areas of consolidation.

By utilizing these technical analysis tools, traders can gain a better understanding of support and resistance levels and increase their confidence in making trading decisions. However, it is important to remember that technical analysis is not foolproof and should be used in conjunction with other forms of analysis and risk management strategies.

8. How to effectively use support and resistance levels in your trading strategy

Support and resistance levels are powerful tools that can greatly enhance your trading strategy. Understanding how to effectively use them can make a significant difference in your trading success.

Firstly, let’s clarify what support and resistance levels are. Support levels are price levels where buying interest is strong enough to prevent the price from falling further. These levels act as a floor for the price, providing a potential buying opportunity. On the other hand, resistance levels are price levels where selling pressure is strong enough to prevent the price from rising further. These levels act as a ceiling for the price, indicating a potential selling opportunity.

To effectively use support and resistance levels in your trading strategy, it is essential to identify them accurately. You can do this by analyzing historical price data and looking for areas where the price has repeatedly reversed or stalled. These areas are likely to indicate significant support or resistance levels.

Once you have identified the key support and resistance levels, you can use them in several ways. One common approach is to use them as entry and exit points for your trades. For example, you may choose to buy when the price bounces off a strong support level, indicating a potential reversal and an opportunity for an upward move. Similarly, you may choose to sell when the price approaches a strong resistance level, anticipating a potential reversal and a downward move.

Support and resistance levels can also be used to set stop-loss orders. Placing a stop-loss order just below a support level can help protect your capital in case the price breaks below that level and continues to decline. Similarly, placing a stop-loss order just above a resistance level can safeguard your profits if the price breaks above that level and continues to rise.

Moreover, support and resistance levels can provide valuable insights into market sentiment and help you anticipate potential market reversals. If a support level is repeatedly tested but holds strong, it suggests that buyers are stepping in at that level, indicating a bullish sentiment. Conversely, if a resistance level is repeatedly tested but remains unbroken, it suggests that sellers are active at that level, indicating a bearish sentiment.

In conclusion, incorporating support and resistance levels into your trading strategy can significantly improve your decision-making process and increase your chances of success. By accurately identifying these levels and utilizing them effectively, you can enhance your entry and exit points, manage your risk, and gain valuable insights into market sentiment.

9. Tips for managing risk and setting stop-loss levels

When it comes to trading in the financial markets, managing risk is crucial. One effective strategy for managing risk is setting stop-loss levels. These levels act as a safety net, limiting potential losses and protecting your capital.

First and foremost, it is important to understand what a stop-loss level is. In simple terms, it is a predetermined price level at which you will exit a trade if the market moves against you. Setting a stop-loss level helps you define your risk tolerance and ensures that you don’t hold on to a losing position for too long.

To determine an appropriate stop-loss level, it is essential to analyze the support and resistance levels on the chart. Support levels are price levels at which the buying pressure is strong enough to prevent the price from falling further. On the other hand, resistance levels are price levels at which the selling pressure is strong enough to prevent the price from rising further.

When setting a stop-loss level, it is advisable to place it just below the nearest support level for long positions and just above the nearest resistance level for short positions. This ensures that if the price breaks below the support level or above the resistance level, it is a clear indication that the market sentiment has changed, and it is time to exit the trade.

It is also essential to consider the volatility of the market when setting your stop-loss level. More volatile markets may require wider stop-loss levels to account for price fluctuations, while less volatile markets may allow for tighter stop-loss levels.

Furthermore, it is important to regularly review and adjust your stop-loss levels as the market conditions change. Trailing stop-loss orders can be a useful tool in this regard, as they automatically adjust the stop-loss level as the price moves in your favor.

Remember, setting stop-loss levels is all about managing risk and protecting your capital. It is crucial to adhere to your predetermined stop-loss levels and not let emotions influence your trading decisions. By effectively managing risk through the use of stop-loss levels, you can enhance your trading strategy and increase your chances of long-term success in the financial markets.

10. Conclusion and key takeaways for successfully analyzing chart patterns

In conclusion, understanding support and resistance levels is crucial for successful chart pattern analysis. By identifying these levels, traders can make more informed decisions and improve their chances of profiting from the market.

Here are the key takeaways for successfully analyzing chart patterns:

1. Support levels act as a floor for prices, while resistance levels act as a ceiling. Identifying these levels helps traders determine the potential direction of price movement.

2. Support and resistance levels can be identified through historical price data, trendlines, and moving averages. These levels can provide valuable insights into market sentiment and potential price reversals.

3. It is important to remember that support and resistance levels are not set in stone. They can shift over time as market dynamics change. Traders should regularly monitor and adjust their analysis accordingly.

4. Confirmation is crucial when analyzing chart patterns. It is advisable to wait for price action to validate the identified support or resistance level before taking any trading decisions.

5. Chart patterns, such as double tops, head and shoulders, or triangles, can further enhance the analysis of support and resistance levels. Learning to recognize and interpret these patterns can provide additional trading opportunities.

6. Risk management is essential in any trading strategy. Setting stop-loss orders and profit targets based on support and resistance levels can help limit potential losses and maximize profits.

By applying these key takeaways, beginners can start demystifying support and resistance levels and improve their ability to analyze chart patterns effectively. Remember, practice and continuous learning are vital in mastering this skill. Happy trading!

To read more article pls click here

Chart Patterns in the Stock Market:

We hope you found our beginner’s guide to chart patterns and support and resistance levels helpful in demystifying these important concepts. Understanding how to identify and interpret support and resistance levels can greatly enhance your trading and investing strategies.

By recognizing these patterns, you can make more informed decisions and increase your chances of success in the market. Remember to practice and study charts to develop your skills further. Happy trading!

FAQ

Where Can I Find Support and Resistance Levels?

You can find support and resistance levels on price charts provided by trading platforms and charting tools. Many trading software applications offer automatic identification of these levels, making it easier for traders to incorporate them into their strategies.

Can I Use Support and Resistance Levels with Other Indicators?

Absolutely. Many traders combine support and resistance levels with other technical indicators like moving averages, RSI, or MACD to make more comprehensive trading decisions. Using multiple indicators can provide a more well-rounded view of the market.

Can Support Become Resistance and Vice Versa?

Yes, this can happen. When a support level is breached, it can turn into a resistance level, and vice versa. Traders often refer to this as a role reversal.Understanding these transitions is important for adapting to changing market conditions.