Demystifying Automated Clearing House (ACH): How It Works and Why It Matters

In modern day global, electronic payments have become the norm. Whether you are paying bills, receiving your revenue, or making buy online, digital bills have made our lives simpler and faster.

One of the maximum popular sorts of digital bills is ACH, or Automated Clearing House. ACH is an electronic community that helps transactions among banks and different financial establishments. It’s used for an extensive variety of economic transactions, consisting of direct deposit, bill bills, and commercial enterprise-to-enterprise payments. Despite its massive use, many humans aren’t acquainted with ACH and how it works.

In this put up, we are able to demystify Automated Clearing House (ACH), explaining what it is, how it works, and why it topics. Whether you’re an enterprise owner or a man or woman, this submits will offer you with a complete understanding of ACH and how it can benefit you.

1. Introduction to Automated Clearing House (ACH)

The Automated Clearing House (ACH) is a critical system that allows digital transactions and transfers budget between one-of-a-kind bank accounts within the United States. It serves because the backbone of the use of ad’s fee infrastructure, processing a staggering variety of transactions each day.

Automated Clearing House (ACH) permits for numerous sorts of payments, inclusive of direct deposits, invoice bills, commercial enterprise-to-commercial enterprise transactions, and man or woman-to-man or woman transfers. It gives a steady and green manner to handle these transactions, lowering the need for paper assessments and guide processing.

At its core, ACH operates by electronically transmitting fee commands from one financial organization to any other. These commands comprise the necessary details, such as the recipient’s account number, the amount to be transferred, and any applicable charge statistics.

The ACH gadget operates on predefined schedules, with batches of transactions processed at precise instances at some stage in the day. This batch processing allows for value-powerful dealing with of a big extent of transactions, making it an attractive alternative for businesses and people alike.

One of the important thing blessings of ACH is its pace and reliability. Unlike conventional paper-primarily based techniques, that can take days for funds to be transferred, ACH transactions are usually processed within one to two commercial enterprise days. This quick turnaround time makes it a perfect answer for routine payments, payroll processing, and different time-sensitive economic sports.

Moreover, Automated Clearing House (ACH) transactions are especially secure, making use of encryption and authentication protocols to shield sensitive facts. Financial institutions and charge processors adhere to strict policies and industry standards to make certain the integrity and confidentiality of the data exchanged inside the ACH network.

Understanding how Automated Clearing House (ACH) works and its significance within the present day financial landscape is vital for agencies and individuals alike. By leveraging this digital payment device, companies can streamline their operations, lessen charges, and enhance coins drift control. For customers, ACH offers convenience, reliability, and delivered protection while undertaking numerous monetary transactions.

In the following sections, we can delve deeper into the mechanics of ACH, exploring its one of kind additives, individuals, and the intricacies of transaction processing. By the quit of this guide, you may have a complete understanding of ACH and its relevance in ultra-modern digital economy. So allows dive in and demystify the sector of Automated Clearing House.

To Read more :- Pls click here

2. What is ACH and how does it paintings?

ACH, or Automated Clearing House, is an extensively used electronic price range transfer gadget within the United States. It permits agencies, organizations, and people to transport cash from one bank account to some other thru a secure and green network.

At its middle, ACH works with the aid of batch-processing transactions, which means that a couple of transactions are grouped together and sent as an unmarried document for processing. This document contains facts inclusive of the sender’s financial institution account info, the recipient’s bank account info, and the quantity to be transferred.

Once the file is submitted to the Automated Clearing House (ACH) network, it undergoes a chain of steps to make certain clean and correct processing. First, the document is demonstrated for mistakes and compliance with ACH rules. Any errors or troubles are flagged, and the document is corrected earlier than shifting ahead.

Next, the file is going through the sorting process. This includes categorizing the transactions based totally on the receiving banks or financial institutions. The ACH community routes every transaction to the respective organization for similar processing.

Once the transactions reach the receiving banks, the budget is either credited or debited from the appropriate money owed. This process generally takes one to two commercial enterprise days, even though equal-day ACH alternatives have become increasingly available.

Automated Clearing House is commonly used for various financial transactions, inclusive of direct deposits, payroll payments, dealer bills, invoice payments, and routine subscription bills. It offers a handy and price-powerful alternative to traditional paper exams, decreasing the want for manual processing and office work.

One of the important thing advantages of Automated Clearing House (ACH) is its reliability and protection. The system adheres to strict pointers and rules to shield each the sender’s and recipient’s financial data. Additionally, ACH transactions can be without problems tracked and reconciled, offering transparency and responsibility for all parties worried.

Understanding how ACH works is important for agencies and people alike, as it affords a dependable and efficient means of shifting price range. By leveraging the energy of ACH, companies can streamline their price tactics, lessen prices, and improve coin glide management.

3. A brief record of ACH and its evolution

The Automated Clearing House (ACH) system has revolutionized the way businesses and people manage economic transactions. But wherein did all of it start? Let’s take a brief a look at the records of ACH and the way it has evolved through the years.

The roots of ACH can be traced returned to the Nineteen Sixties when they want for an extra green and automatic method of transferring budget became obvious. At that point, assessments were the primary mode of payment, and the manner changed into gradual, manual, and prone to mistakes. There turned into a clean call for a device that could streamline those transactions and lead them to greater stability.

In response, the National Automated Clearing House Association (NACHA) turned into shaped in 1974. This affiliation aimed to create a national digital price range switch machine that could replace the traditional paper-based totally strategies. The first Automated Clearing House (ACH) bills had been added within the overdue Nineteen Seventies, initially confined to direct deposit of payroll and authorities gain bills.

Over the years, the ACH machine underwent tremendous improvements. The introduction of the Electronic Funds Transfer Act in 1978 further facilitated the boom of ACH with the aid of regulating digital transactions and ensuring purchaser safety. This regulation laid the muse for the sizable adoption of ACH as a dependable and secure fee approach.

As technology stepped forward, so did the abilities of ACH. In the Nineteen Nineties, the ACH community increased to include various forms of transactions, including ordinary bills, commercial enterprise-to-business transactions, and on-line bill payments. This enlargement spread out new opportunities for groups and people to conduct their financial affairs efficaciously and conveniently.

Today, Automated Clearing House (ACH) has come to be a crucial part of the economic panorama, processing billions of transactions annually. It permits organizations to acquire bills from clients, pay companies and employees, and manage other economic duties seamlessly. Individuals can use ACH for various purposes, together with direct deposit of salaries, paying payments, and transferring budget among debts.

The evolution of ACH has brought several advantages to each organization and client. It has reduced reliance on paper assessments, ensuing in quicker and greater stable transactions. The automated nature of ACH gets rid of the want for guide processing, lowering costs and minimizing errors. Moreover, ACH permits for smooth integration with accounting structures and provides special transaction statistics, improving monetary management and reporting abilities.

In end, expertise the records and evolution of Automated Clearing House (ACH) allows us appreciates the great effect it has had at the way we deal with monetary transactions. From its humble beginnings to its present day sizable utilization, ACH has simplified and streamlined the payment method, making it an vital tool for organizations and individuals alike.

4. The benefits of ACH for groups and clients

To Read more :- Pls click here

Automated Clearing House (ACH) is an essential machine that helps digital payments and transfers between specific financial establishments. While it can seem complicated before everything, information the advantages of ACH for each companies and customers can help demystify this fee technique and spotlight its importance in modern-day virtual economic system.

For businesses, ACH gives numerous benefits. Firstly, it offers a value-effective opportunity to conventional paper-based fee strategies along with tests. By making use of ACH, organizations can significantly reduce the costs related to printing, issuing, and processing physical assessments, ensuing in enormous savings over the years.

ACH additionally streamlines the payment manner, making it quicker and greater green. Unlike conventional strategies that require guide managing and processing, ACH transactions are automated, permitting agencies to ship and get hold of bills seamlessly.

This performance no longer best saves time however additionally improves cash drift control, as finances are electronically deposited at once into the commercial enterprise’s account, decreasing the time spent awaiting assessments to clean.

Furthermore, ACH gives more advantageous security compared to standard price techniques. With ACH, touchy economic information is encrypted and transmitted securely, decreasing the risk of fraud and unauthorized get entry to account info.

This now not only provides peace of mind for businesses however additionally instils consider among consumers, strengthening the general commercial enterprise-consumer courting.

From a patron perspective, ACH brings numerous blessings as properly. It offers convenience and flexibility, permitting people to make payments and receive budget electronically, eliminating the want for bodily cash or checks.

Whether it’s paying bills, receiving wages, or shifting budget between money owed, ACH simplifies the process, making economic transactions easier and more on hand.

In addition, ACH offers purchasers with greater control over their budget. With capabilities along with routine bills and automated transfers, individuals can set up regular invoice payments or savings contributions, making sure well timed and consistent financial management. This reduces the risk of overlooked payments or overdue costs, improving economic balance and employer.

Overall, the advantages of ACH for organizations and consumers are clean. It gives value financial savings, performance, safety, convenience, and manipulate, making it a crucial device in modern digital fee panorama. By knowledge how ACH works and embracing its blessings, organizations and individuals can harness its potential to optimize their financial operations and enhance ordinary economic nicely-being.

5. How ACH transactions are processed

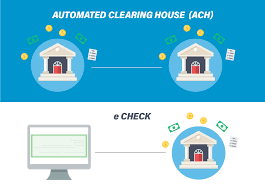

ACH transactions are an essential issue of the current banking system, facilitating secure and efficient electronic transfers among monetary institutions. Understanding how ACH transactions are processed can demystify this complex but essential system.

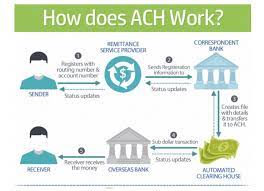

When a patron initiates an ACH transaction, which includes paying a bill or receiving a direct deposit, the procedure starts with the originator, or the birthday celebration beginning the transaction. The originator collects the important statistics from the receiver, commonly which includes their bank account range and routing number.

Once the originator has these records, they create an ACH report that contains the transaction details. This document is then transmitted to an originating depository monetary group (ODFI), which is generally the originator’s bank. The ODFI reviews the document for accuracy and compliance with ACH regulations earlier than filing it to the ACH network.

The ACH community acts as a clearinghouse, facilitating the trade of budget and statistics between financial institutions. Upon receiving the ACH record, the network processes the transactions in batches, generally based totally on their agreement times. The network verifies the validity of each transaction, checking for sufficient funds, proper account facts, and compliance with ACH recommendations.

Once the ACH community has completed the essential tests, it forwards the transactions to the receiving depository financial institution (RDFI), that’s the financial institution of the receiver. The RDFI then credit or debits the suitable accounts primarily based on the transaction instructions.

Throughout this method, various security measures are in area to protect the integrity and confidentiality of the facts being transmitted. Encryption firewalls, and authentication protocols ensure that touchy facts stays secure.

The whole ACH transaction manner generally takes one to 2 business days, with budget being transferred from the originator’s account to the receiver’s account electronically. This green and price-powerful approach of price processing has revolutionized the way businesses and individual’s behaviour financial transactions.

Understanding how ACH transactions are processed is essential for organizations and customers alike. By leveraging the energy of ACH, agencies can streamline their charge processes, lessen prices, and enhance coins glide. For purchasers, ACH gives convenience, protection, and quicker get admission to finances, making it an increasingly more popular choice for various financial transactions.

6. Different forms of ACH transactions

There are numerous sorts of Automated Clearing House (ACH) transactions that serve one-of-a-kind functions and cater to various wishes. Understanding those different types can assist companies and individuals make informed decisions approximately their financial transactions.

Direct Deposit:

This is one of the most common varieties of ACH transactions. It allows employers to deposit salaries, wages, or different payments without delay into their personnel’ bank debts. Direct deposit eliminates the need for paper exams and provides a convenient and green way to acquire funds.

Direct Payment:

This sort of ACH transaction permits organizations or individuals to make bills to carriers, suppliers, application companies, or even individuals immediately from their financial institution debts. It gives a secure and fee-powerful alternative to writing and mailing paper tests.

Electronic Funds Transfer (EFT):

EFT transactions involve the switch of funds among one-of-a-kind financial institution accounts. This can encompass moving cash among personal accounts, making payments to lenders, or maybe settling bills with carrier carriers. EFT transactions are initiated by way of the account holder and can be installation as ordinary or one-time transfers.

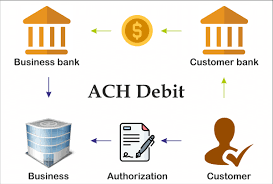

Pre-Authorized Debit (PAD):

PAD transactions are commonly used for routine payments which include subscriptions, memberships, or month-to-month payments. With the account holder’s consent, the billing company can provoke PAD transactions to automatically withdraw budget from the consumer’s bank account on certain dates.

Corporate Payments:

ACH transactions additionally facilitate business-to-enterprise bills, allowing groups to efficiently handle payroll, supplier bills, and other monetary duties. These transactions are often used for excessive-volume, low-cost payments, streamlining the fee technique for corporations.

Understanding the distinctive types of ACH transactions can help people and companies leverage the advantages of electronic bills. Whether it’s receiving salaries, making bills, moving price range, or coping with habitual payments, ACH offers a steady, green, and cost-powerful alternative to traditional price strategies. By embracing the ease of ACH, individuals and groups can streamline their economic strategies and experience the benefits of a digitized price atmosphere.

To Read more:- Pls click here

7. The position of financial institutions in ACH transactions

Financial institutions play a critical function in facilitating Automated Clearing House (ACH) transactions. As the backbone of the ACH network, these establishments function intermediaries between the sending and receiving events, making sure seamless and stable transactions.

When an Automated Clearing House (ACH) fee is initiated, the sender’s economic group acts as the originating depository financial institution (ODFI). They acquire the price instructions from the sender, such as the necessary details including the recipient’s account wide variety, routing range, and the quantity to be transferred.

Once the ODFI receives the price commands, they bundle a couple of transactions together in batches and send them to an ACH operator. The ACH operator acts as a principal hub, processing and routing these batches to the correct receiving monetary institutions.

The receiving monetary group, called the receiving depository monetary group (RDFI), gets the batch of Automated Clearing House transactions from the ACH operator. They then process and distribute the funds to the recipients’ money owed, primarily based at the data furnished in the payment instructions.

Throughout this complete procedure, monetary institutions play an essential position in making sure the accuracy and safety of Automated Clearing House transactions. They validate the sender’s account and price range availability, affirm the recipient’s account records, and adhere to strict regulatory suggestions to prevent fraud and unauthorized transactions.

Furthermore, economic establishments additionally offer important services like customer support, dispute decision, and reconciliation for Automated Clearing House transactions. They act as depended on intermediaries, offering assistance and guidance to both senders and recipients in case of any issues or discrepancies.

In précis, economic institutions are fundamental to the functioning of ACH transactions. Their position as ODFIs and RDFIs, along with their obligations in processing, routing, and safeguarding transactions, ensures the efficiency, reliability, and security of the ACH network. Without their active participation, the seamless digital movement of budget via the ACH gadget might no longer be viable.

8. Common use instances for ACH bills

ACH bills have turn out to be increasingly famous in current years, revolutionizing the way groups and individuals manage their monetary transactions. With its convenience, security, and cost-effectiveness, ACH has discovered its way into numerous use cases across one of kind industries.

Payroll:

ACH is extensively used for processing payroll payments. Employers can easily transfer price range at once to their employees’ financial institution bills, doing away with the need for paper checks and reducing administrative costs. This method ensures timely and green fee, allowing employees to get entry to their finances speedy.

Vendor and Supplier Payments:

Many companies make use of ACH bills to make payments to their carriers and suppliers. By putting in place automated payments, agencies can streamline their money owed payable process, saving time and decreasing the threat of mistakes. This approach additionally affords a clean report of charge history and simplifies reconciliation.

Subscription Services:

Subscription-based totally groups, which include streaming systems, software carriers, and membership agencies, often depend upon ACH bills for ordinary billing. With ACH, clients can authorize automated payments, ensuring a seamless and problem-unfastened revel in. This gets rid of the need for manual invoicing and decreases the risk of price delays or overlooked payments.

E-trade:

ACH bills are an increasing number of being incorporated into on line buying platforms. By presenting ACH as a fee alternative, businesses can offer customers with an opportunity to credit score cards and digital wallets. This is especially useful for customers who choose to pay immediately from their financial institution money owed or folks who do now not have get entry to conventional fee strategies.

Non-Profit Organizations:

ACH payments are widely used by non-income companies to acquire donations and contributions. By permitting donors to set up habitual Automated Clearing House transfers, non-profits can set up a constant and reliable source of investment. This technique additionally reduces transaction expenses, ensuring that a bigger portion of the donation is going toward the supposed motive.

In summary, ACH payments offer a flexible solution for various economic transactions. Whether it’s streamlining payroll methods, facilitating dealer bills, assisting subscription offerings, permitting e-trade, or empowering non-income companies, ACH has tested to be a treasured tool in cutting-edge-day monetary operations. Understanding the not unusual use instances for ACH bills can help organizations and people leverage this era to their gain.

9. Security measures and fraud prevention in ACH

When it comes to economic transactions, security need to usually be a top priority. The Automated Clearing House (ACH) gadget, which facilitates electronic finances transfers, recognizes the importance of protecting touchy information and preventing fraudulent sports.

To make sure the security of ACH transactions, multiple layers of security features are applied. Financial institutions and ACH operators adhere to strict protection protocols and appoint sturdy encryption techniques to shield the transmission and garage of data. This enables prevent unauthorized get admission to and protects touchy facts such as account numbers, routing numbers, and private info.

Additionally, Automated Clearing House transactions undergo stringent authentication processes. Before starting up a transaction, each the sender and receiver are required to offer authenticating facts to validate their identities. This allows in preventing fraudulent people from initiating or intercepting transactions.

Furthermore, ACH structures contain multiple degrees of fraud prevention mechanisms. Advanced algorithms and synthetic intelligence technologies are applied to hit upon suspicious patterns, unusual activity, and capability fraud attempts. These systems continuously display transactions in actual-time, figuring out and flagging any suspicious behaviour or discrepancies.

Financial institutions and ACH operators additionally collaborate and share information regarding fraud developments and rising threats. This collaborative effort allows for the timely implementation of countermeasures and the improvement of greater security protocols.

It is essential to be aware that at the same time as Automated Clearing House systems appoint sturdy security measures, character users additionally play an important role in shielding themselves towards fraud. This consists of often tracking account interest, right away reporting any suspicious transactions or unauthorized get admission to, and keeping sturdy passwords and protection practices.

By imposing complete security features and fraud prevention techniques, the Automated Clearing House system guarantees the integrity and trustworthiness of digital funds transfers, giving agencies and individuals the peace of mind they need when conducting financial transactions.

10. The future of Automated Clearing House and its impact on the monetary enterprise

The Automated Clearing House (ACH) system has come an extended way considering its inception, and its future holds terrific ability to revolutionize the economic enterprise. As technology continues to boost, ACH is evolving to satisfy the converting wishes of corporations and purchasers alike.

One of the key regions wherein Automated Clearing House is creating a large impact is in the realm of faster payments. Traditionally, ACH transactions took numerous business days to process, inflicting delays in fund transfers. However, with the creation of Same Day ACH, budget can now be transferred in the equal day, offering corporations and people with greater convenience and efficiency.

Furthermore, the growing adoption of real-time bills is about to reshape the panorama of Automated Clearing House. Real-time payments allow instantaneous fund transfers, taking into consideration seamless transactions and improving the general patron enjoy. This development is specifically essential in present day fast-paced digital global, where consumers anticipate immediately gratification and companies require speedy bills for his or her operations.

Additionally, the mixing of ACH with rising technology along with block chain and synthetic intelligence holds huge promise. These technologies have the ability to decorate protection, lessen fraud, and streamline techniques in the Automated Clearing House system. As economic establishments and fetch companies include these advancements, we are able to assume to look further enhancements inside the speed, accuracy, and transparency of ACH transactions.

The destiny of ACH additionally extends beyond home borders. As worldwide trade maintains to increase, there may be a developing want for green move-border payment answers. ACH, with its mounted infrastructure and tested music file, is properly positioned to play a pivotal function in facilitating worldwide transactions, fostering monetary growth, and promoting monetary inclusion on a worldwide scale.

In the end, the future of Automated Clearing House holds exciting opportunities for the financial enterprise. With improvements in faster payments, real-time transactions, integration with emerging technology, and its ability as an international price answer, ACH is poised to shape the way we conduct economic transactions for years to come. As agencies and clients include the benefits of ACH, we will count on a more interconnected and streamlined economic surroundings that empowers economic increase and innovation.

To Read more:- Pls click here

We desire this blog submit has shed light on the frequently complicated subject matter of Automated Clearing House (ACH) and furnished you with a clear know-how of how it really works and why it matters. ACH is an important part of current banking and payment structures, facilitating steady and efficient electronic transactions.

By demystifying ACH, we are hoping to have empowered you with the know-how needed to navigate this critical factor of financial transactions. As you hold your adventure in the international of banking and finance, recollect leveraging the strength of ACH to streamline your payments and revel in the benefits it gives.

FAQ

What is an Automated Clearing House (ACH)?

An Automated Clearing House (ACH) is an electronic network that facilitates the secure and efficient transfer of funds between different financial institutions. It allows for the electronic movement of money for various transactions, including direct deposits, bill payments, business-to-business payments, and more.

What types of transactions can be processed through ACH?

ACH is used for a variety of transactions, including: Direct Deposits: Payroll, government benefits, pensions, and tax refunds. Direct Payments: Bill payments, loan payments, and subscription payments. Business-to-Business Payments: Supplier payments, reimbursements, and invoice settlements. Person-to-Person Payments: Transfers between individuals, often facilitated by peer-to-peer payment apps.

Is ACH secure?

Yes, ACH transactions are secure. The system employs encryption, authentication, and multiple layers of security measures to protect sensitive financial data and prevent unauthorized access.