Technical analysis is an important aspect of trading that helps traders make informed decisions based on market trends and patterns. One such pattern is the hammer candlestick pattern, which is a powerful tool that can help traders identify potential trend reversals in the market. A hammer candlestick pattern is a bullish reversal pattern that occurs at the bottom of a downtrend.

It is characterized by a small body with a long lower shadow, which looks like a hammer. This pattern signifies that buyers have entered the market and are attempting to push prices higher. In this post, we will explore the hammer candlestick pattern in detail, including how to identify it and how to use it in your trading strategy. Whether you are a seasoned trader or just starting out, this post will give you the insights you need to make informed trading decisions using the hammer candlestick pattern.

1. Introduction to candlestick patterns in technical analysis

Candlestick patterns are a fundamental tool in technical analysis, providing valuable insights into market trends and potential price reversals. Among the numerous candlestick patterns, one that stands out for its significance and reliability is the Hammer pattern.

The concept of candlestick patterns originated in Japan centuries ago, where rice traders used them to analyze market behavior. Today, these patterns have become widely popular among traders and investors worldwide, due to their ability to provide visual cues about market sentiment and potential price movements.

Candlestick patterns are formed by the open, high, low, and close prices of an asset during a specific timeframe. By examining the shape, size, and position of these candlesticks, traders can gain valuable information about the balance of power between buyers and sellers.

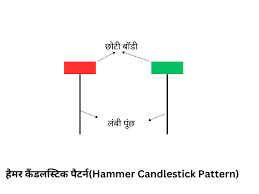

The Hammer pattern is characterized by a small body with a long lower shadow, resembling the shape of a hammer. This pattern typically occurs after a downtrend and indicates a potential bullish reversal. The long lower shadow represents the rejection of lower prices, as buyers step in to push the price back up. The small body suggests that sellers are losing momentum.

Traders often consider the Hammer pattern as a reliable signal for entering a long position or closing a short position. However, it is important to confirm this pattern with other technical indicators or chart patterns to increase the accuracy of the analysis.

In summary, candlestick patterns are powerful tools in technical analysis, providing traders with valuable insights into market dynamics. The Hammer pattern, with its unique characteristics, can serve as a reliable indicator of potential trend reversals. By understanding and incorporating these patterns into their analysis, traders can enhance their decision-making process and improve their chances of success in the financial markets.

2. Understanding the basics of hammer candlestick pattern

Understanding the basics of the hammer candlestick pattern is essential for any technical analyst looking to make informed trading decisions. The hammer pattern is a powerful tool that can provide valuable insights into market trends and potential reversals.

Visually, the hammer pattern resembles a hammer, with a small body at the top and a long lower shadow, resembling the handle. The pattern forms when the market opens, trades lower during the session, but ultimately closes near or above the opening price. This indicates a potential shift in market sentiment from bearish to bullish.

The significance of the hammer pattern lies in its interpretation. It suggests that despite the selling pressure during the session, buyers were able to regain control and push the price higher, often signaling a potential reversal. This can be particularly relevant in downtrends, where the hammer pattern could indicate a possible trend reversal and the start of an upward move.

However, it’s important to consider the context in which the hammer pattern appears. Is it forming at a key support level? Are there other technical indicators supporting the potential reversal? These factors can help confirm the reliability of the hammer pattern and increase its predictive power.

Traders and analysts often look for confirmation signals before acting upon the hammer pattern. This can include observing higher trading volumes during the formation of the pattern, or waiting for a bullish confirmation candle in the subsequent sessions. These additional signals can provide further confidence in the potential reversal indicated by the hammer pattern.

In conclusion, understanding the basics of the hammer candlestick pattern is a valuable skill for technical analysts. By recognizing the pattern’s visual characteristics and interpreting its significance in the broader market context, traders can make more informed decisions and potentially capitalize on potential trend reversals.

3. Anatomy of a hammer candlestick

The hammer candlestick pattern is a widely recognized and powerful tool in technical analysis. Its distinctive shape and characteristics provide valuable insights into market sentiment and potential trend reversals. To fully understand and utilize this pattern, it’s essential to dissect its anatomy.

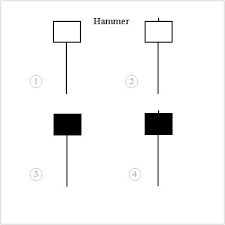

At first glance, a hammer candlestick resembles, well, a hammer! It consists of a small body with a long lower shadow, or wick, and little to no upper shadow. The body represents the opening and closing prices, while the shadows extend from the body, indicating the range of price action.

The most crucial element of the hammer candlestick is its long lower shadow, which typically extends at least twice the length of the body. This lower shadow represents the intraday low, indicating that sellers pushed the price down significantly during the trading session. However, the bulls managed to take control and push the price back up, resulting in a strong rebound.

The absence or minimal presence of an upper shadow suggests that sellers were unable to regain control, reflecting a potential shift in market sentiment. This bullish reversal signal becomes even more potent when the hammer forms after a downtrend, indicating the possibility of a trend reversal.

While the color of the body is not of primary importance, many traders consider a green or white body more bullish, indicating a higher closing price compared to the opening price. Conversely, a red or black body suggests a lower closing price.

When identifying a hammer candlestick, it’s crucial to consider the context in which it appears. Is it forming at a significant support level or a key Fibonacci retracement level? Is there a confluence of other technical indicators, such as trendlines or moving averages, strengthening the potential reversal signal?

In conclusion, understanding the anatomy of a hammer candlestick is essential for successful technical analysis. It provides valuable insights into market sentiment, potential reversals, and can guide trading decisions. By combining this knowledge with other technical tools and confirming signals, traders can harness the power of the hammer candlestick pattern to make informed and strategic trading decisions.

4. Interpreting the significance of a hammer candlestick

Interpreting the significance of a hammer candlestick pattern is crucial in technical analysis. The hammer pattern is considered a powerful tool due to its potential to indicate a trend reversal. This candlestick pattern forms when the price opens near its high, then experiences a significant decline during the trading session, and finally closes near its open.

The shape of a hammer candlestick resembles a hammer, with a small body and a long lower shadow. The body represents the opening and closing prices, while the shadow represents the high and low prices during the session. The long lower shadow of the hammer indicates that sellers pushed the price lower, but buyers managed to regain control and push it back up.

When interpreting the significance of a hammer candlestick, it is important to consider the following factors:

1. Location:

The hammer pattern is more significant when it appears after a downtrend, as it suggests a potential reversal. It indicates that buyers are stepping in and rejecting lower prices, potentially leading to a bullish reversal.

2. Volume:

High trading volume accompanying the hammer pattern strengthens its significance. It suggests increased market participation and confirms the potential reversal indicated by the candlestick pattern.

3. Confirmation:

Traders often wait for confirmation of the hammer pattern before making trading decisions. This confirmation can come in the form of a bullish candlestick that forms after the hammer, indicating further upward momentum.

4. Timeframe:

The significance of a hammer candlestick may vary depending on the timeframe being analyzed. It is important to consider the overall trend and the timeframe being used to ensure accurate interpretation.

While the hammer candlestick pattern can be a powerful tool in technical analysis, it is essential to combine it with other indicators and analysis techniques to increase the probability of successful trades. It is also important to remember that candlestick patterns are not infallible and should be used in conjunction with risk management strategies.

5. Bullish reversal signal: Identifying hammer candlestick in an uptrend

When it comes to technical analysis, the hammer candlestick pattern is a powerful tool for identifying potential bullish reversals in an uptrend. This pattern is characterized by a small body at the upper end of the candlestick, with a long lower shadow that is at least twice the length of the body. The shape of the candlestick resembles that of a hammer, hence its name.

To identify a hammer candlestick in an uptrend, you should look for the following criteria:

1. Uptrend:

The first step is to ensure that there is a prevailing uptrend in the price action. This can be determined by analyzing the series of higher highs and higher lows on the chart.

2. Small body:

The body of the candlestick should be relatively small, indicating that there is indecision in the market. The color of the body is not as significant in this pattern.

3. Long lower shadow:

The most distinctive feature of the hammer pattern is the long lower shadow, which represents the rejection of lower prices by the bulls. This shows that despite some selling pressure, the buyers were able to push the price back up.

When you spot a hammer candlestick in an uptrend, it suggests that the bulls are gaining strength and that a potential bullish reversal might occur. This is because the long lower shadow indicates that buyers are stepping in at lower levels, creating a support level for the price.

However, it’s important to note that the hammer candlestick pattern should not be considered in isolation. It is always recommended to analyze it within the context of other technical indicators, such as trendlines, support and resistance levels, and volume.

By recognizing and understanding the hammer candlestick pattern in an uptrend, you can effectively identify potential buying opportunities and make informed trading decisions.

6. Bearish reversal signal: Identifying inverted hammer candlestick in a downtrend

The inverted hammer candlestick pattern is a powerful tool when it comes to identifying bearish reversals in a downtrend. As the name suggests, this pattern resembles an upside-down hammer, with a small body and a long upper shadow. It indicates that buyers attempted to push the price higher, but ultimately failed, resulting in a potential trend reversal.

To identify an inverted hammer candlestick, look for the following characteristics:

1. Downtrend:

The market should be in a clear and established downtrend, characterized by lower lows and lower highs. This pattern is most effective when it occurs within this context.

2. Small body:

The body of the candlestick should be relatively small, indicating indecision between buyers and sellers.

3. Long upper shadow:

The upper shadow of the candlestick should be significantly longer than the body, showing that buyers initially pushed the price higher but were met with strong selling pressure.

When you spot an inverted hammer in a downtrend, it suggests that sellers are gaining control and that a potential reversal may be on the horizon. However, it’s important to remember that this pattern is not foolproof and should be used in conjunction with other technical indicators and analysis tools.

Traders often wait for confirmation before taking action based on the inverted hammer pattern. This could involve waiting for a subsequent candlestick to close lower than the inverted hammer’s low or a break of a key support level. Additionally, it’s crucial to consider the overall market conditions, news events, and other factors that may influence price movements.

In conclusion, the inverted hammer candlestick pattern can be a valuable tool for technical analysts, signaling a potential bearish reversal in a downtrend. However, it should be used in conjunction with other analysis techniques and confirmed by additional factors before making trading decisions.

7. Tips for using hammer candlestick pattern effectively

When it comes to technical analysis in trading, the hammer candlestick pattern is a powerful tool that can provide valuable insights. This pattern, named after its resemblance to a hammer, can indicate potential reversals in price trends. However, using the hammer candlestick pattern effectively requires some tips and strategies to maximize its potential.

1. Confirm the pattern:

The hammer candlestick pattern should not be relied upon solely for making trading decisions. It is crucial to confirm the pattern with other technical indicators or chart patterns. Look for additional signals such as trendlines, support and resistance levels, or volume patterns that align with the hammer pattern. This confirmation helps to increase the reliability of the signal.

2. Consider the context:

Context is key in technical analysis. Evaluate the hammer candlestick pattern within the broader market context. Is it forming at a significant support level, after a prolonged downtrend, or near a key Fibonacci retracement level? Understanding the context can provide additional confidence in the potential reversal indicated by the hammer pattern.

3. Take note of the size and location:

The size and location of the hammer candlestick can provide valuable clues about market sentiment and potential price movements. A long lower shadow (or wick) combined with a small real body is considered more bullish, indicating a stronger potential reversal. Additionally, a hammer pattern occurring near a major support level tends to carry more significance.

4. Wait for confirmation:

Patience is crucial when using the hammer candlestick pattern. It is advisable to wait for confirmation before entering a trade. This can be in the form of a bullish follow-through candle or a break above a nearby resistance level. Waiting for confirmation helps to filter out false signals and increases the probability of a successful trade.

5. Set appropriate stop-loss levels:

As with any trading strategy, it is essential to manage risk effectively. Determine appropriate stop-loss levels based on the price action and the distance to nearby support levels. Placing stop-loss orders below the low of the hammer candlestick or below the nearest support level can help protect against potential losses.

By following these tips, traders can harness the power of the hammer candlestick pattern more effectively. Remember, technical analysis is a tool to assist in decision-making, but it should not be the sole basis for trades. Combine it with other analysis techniques and risk management strategies for a well-rounded trading approach.

8. Combining hammer pattern with other technical indicators

Combining the hammer candlestick pattern with other technical indicators can greatly enhance the accuracy of your analysis and trading decisions. While the hammer pattern itself is a strong bullish signal, incorporating additional indicators can provide confirmation and help filter out false signals.

One popular indicator to consider is the Relative Strength Index (RSI). The RSI measures the strength and momentum of a stock or asset and can help determine if it is overbought or oversold. When combined with a hammer pattern, a bullish reversal signal on the RSI can provide further validation of an impending upward price movement.

Another useful indicator to pair with the hammer pattern is the Moving Average Convergence Divergence (MACD). The MACD is a trend-following momentum indicator that highlights potential changes in the direction of a trend. When the hammer pattern appears alongside a bullish crossover on the MACD, it reinforces the likelihood of a bullish reversal.

Additionally, incorporating volume analysis can provide valuable insights when combined with the hammer pattern. An increase in volume during the formation of a hammer can indicate strong buying interest and further support the potential for a bullish reversal.

It’s important to note that while combining indicators can be powerful, it’s crucial to consider the overall market conditions and other relevant factors. Technical analysis is most effective when used in conjunction with fundamental analysis and a comprehensive understanding of the broader market context.

By combining the hammer pattern with other technical indicators, you can increase your confidence in identifying profitable trading opportunities and improve the overall accuracy of your technical analysis. Remember to backtest your strategies and always consider risk management principles to ensure a well-rounded trading approach.

9. Real-life examples of hammer candlestick pattern in action

The hammer candlestick pattern is a powerful tool in technical analysis that can provide valuable insights into market trends and potential reversals. To better understand its significance, let’s explore some real-life examples of the hammer candlestick pattern in action.

Example 1: Bullish Reversal

Imagine you are analyzing the price chart of a stock that has been in a downtrend for some time. Suddenly, you notice a hammer candlestick forming at a key support level. The long lower shadow of the hammer indicates that sellers pushed the price down but were eventually overwhelmed by buyers who pushed it back up. This signals a potential bullish reversal, suggesting that the stock may start an upward trend.

Example 2: Confirmation of Support

In another scenario, you are analyzing the price chart of a cryptocurrency that has experienced a sharp decline. As the price approaches a significant support level, a hammer candlestick forms, reinforcing the idea that this level is holding strong. The long lower shadow indicates buying pressure and suggests that buyers are stepping in at that support level, potentially leading to a price rebound.

Example 3: Entry or Exit Signal

The hammer candlestick pattern can also be used as an entry or exit signal for traders. Let’s say you are monitoring a forex pair that has been in an uptrend, and you spot a hammer candlestick after a minor pullback. This could be a signal to enter a long position, as the pattern suggests that buyers are actively pushing the price higher. Conversely, if you already have a long position and you notice a hammer candlestick forming after a prolonged uptrend, it may serve as an early warning sign of a potential trend reversal, prompting you to consider exiting the trade.

By observing real-life examples of the hammer candlestick pattern, traders and investors can enhance their technical analysis skills and make more informed decisions in the financial markets. However, it’s important to remember that no single indicator or pattern guarantees success. It is always advisable to use the hammer candlestick pattern in conjunction with other technical analysis tools and to consider the broader market context before making any trading decisions.

10. Conclusion: Harnessing the power of hammer candlestick pattern

In conclusion, the hammer candlestick pattern is a powerful tool that can greatly enhance your technical analysis skills. By understanding and recognizing this pattern, you can gain valuable insights into market trends and potential reversals.

The hammer candlestick pattern, with its distinct shape and characteristics, provides traders with a visual representation of market sentiment. Its long lower shadow and small real body indicate that buyers have stepped in to push prices higher after a period of selling pressure. This can be a strong indication that a bullish reversal is imminent.

By harnessing the power of the hammer candlestick pattern, traders can make more informed decisions about their entry and exit points. When combined with other technical indicators and analysis tools, the hammer pattern can provide confirmation and increase the likelihood of successful trades.

It is important to note that like any technical analysis tool, the hammer candlestick pattern is not foolproof and should be used in conjunction with other forms of analysis. Additionally, it is essential to consider the broader market context and not rely solely on the presence of a hammer pattern.

With practice and experience, traders can become proficient in identifying and utilizing the hammer candlestick pattern to their advantage. By incorporating this powerful tool into their trading strategies, they can increase their chances of success in the dynamic and ever-changing financial markets.

In conclusion, the hammer candlestick pattern is a valuable addition to any trader’s toolbox. By mastering its interpretation and application, traders can gain a deeper understanding of market dynamics and improve their overall trading performance. So, take the time to study and practice using the hammer pattern, and unlock its potential to bolster your technical analysis skills and enhance your trading outcomes.

To read more article pls click here

Demystifying Support and Resistance Levels

We hope this blog post has provided you with valuable insights into the hammer candlestick pattern and its significance in technical analysis. As one of the most powerful tools in identifying potential market reversals, mastering the interpretation of this pattern can greatly enhance your trading skills.

By understanding the psychology behind the hammer candlestick and its implications on price action, you’ll be better equipped to make informed trading decisions. Remember, practice and experience are key to becoming proficient in technical analysis, so keep honing your skills and incorporating the hammer candlestick pattern into your trading strategy. Happy analyzing and happy trading!

FAQ

How should traders manage risk when using the Hammer pattern?

Risk management is essential when trading based on candlestick patterns. Traders should always use stop-loss orders to limit potential losses. They should also be aware of the overall market conditions and not rely solely on a single pattern for their trading decisions.

Can a Hammer pattern be combined with other candlestick patterns?

Yes, traders often combine the Hammer pattern with other candlestick patterns and technical indicators to increase the probability of a successful trade. Common combinations include Hammer patterns with bullish confirmation patterns, like Morning Stars or Bullish Engulfing patterns.

Where is the best place to look for Hammer patterns?

Hammer patterns can be found on various financial charts, including stock charts, forex charts, and commodity charts. They are most effective when identified after a prolonged downtrend as they signal a potential change in market sentiment.