Technical analysis is an essential tool for traders who want to make informed decisions in the financial markets. One of the most fundamental concepts in technical analysis is support and resistance. These two concepts are the foundation of chart patterns and help traders identify key levels in the market.

By understanding support and resistance, traders can make better decisions about when to enter and exit trades, and where to set stop-loss orders. In this blog post, we will delve deep into support and resistance, unlocking chart patterns, and technical analysis. We will cover what support and resistance are, how they work, and how to use them to improve your trading strategies. Whether you are a beginner or an experienced trader, this post will provide you with valuable insights into mastering support and resistance in technical analysis.

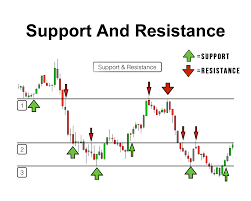

1. Introduction to support and resistance in technical analysis

Technical analysis is a powerful tool used by traders and investors to make informed decisions in the financial markets. One of the fundamental concepts in technical analysis is support and resistance. These terms refer to specific price levels on a chart that have historically shown to influence the behavior of an asset.

Support is a price level at which buying pressure is expected to overcome selling pressure, causing the price to stop falling and potentially reverse its direction. It acts as a floor, preventing further downward movement. Traders often see support levels as potential buying opportunities, as they believe that the price is unlikely to drop significantly below this level.

On the other hand, resistance is a price level at which selling pressure is expected to overcome buying pressure, causing the price to stop rising and potentially reverse its direction. It acts as a ceiling, preventing further upward movement. Traders tend to view resistance levels as potential selling opportunities, as they anticipate that the price will struggle to break through this level.

Support and resistance levels are typically identified by analyzing historical price data on a chart. Traders look for areas where the price has previously struggled to move beyond (resistance) or where it has consistently found buying interest (support). These levels can be identified using various technical tools and indicators, such as trendlines, horizontal lines, moving averages, and Fibonacci retracements.

Understanding support and resistance is crucial because they provide valuable insights into an asset’s price behavior. They represent key psychological levels where market participants have previously shown significant interest in buying or selling. When the price approaches these levels, traders pay close attention to see how the market reacts, as it can influence their trading decisions.

In the following sections of this blog post, we will delve deeper into various chart patterns that involve support and resistance. By mastering these patterns, you will be able to identify potential trading opportunities and improve your overall technical analysis skills. So, let’s explore these chart patterns and unlock the secrets of support and resistance in technical analysis.

2. Understanding the basics: What are support and resistance levels?

Support and resistance levels are fundamental concepts in technical analysis that play a crucial role in understanding and interpreting chart patterns. These levels are key price levels on a chart where the buying and selling pressure of the market tends to be concentrated.

Support levels act as price floors, preventing the price from falling further. They are formed when the demand for an asset exceeds the supply, causing buyers to step in and push the price back up. Support levels indicate areas where traders believe the price is attractive enough to buy, leading to an increase in buying activity.

On the other hand, resistance levels act as price ceilings, preventing the price from rising further. They are formed when the supply of an asset exceeds the demand, causing sellers to enter the market and push the price back down. Resistance levels indicate areas where traders believe the price is too high to justify further buying, leading to an increase in selling activity.

Understanding these levels is crucial because they provide valuable insights into the psychology of market participants. Support and resistance levels can help traders identify potential entry and exit points, as well as determine the strength or weakness of a trend.

When a price breaks above a resistance level, it is often seen as a bullish signal, suggesting that buyers have gained control and the price may continue to rise. Conversely, when a price breaks below a support level, it is seen as a bearish signal, indicating that sellers have gained control and the price may continue to decline.

Moreover, support and resistance levels can act as areas of congestion, where the price tends to consolidate or trade within a range. Traders often look for breakouts above resistance or below support to capitalize on potential trend reversals or continuation patterns.

By understanding the basics of support and resistance levels, traders can gain a deeper understanding of market dynamics and make more informed trading decisions. These levels serve as essential tools in technical analysis and are key to unlocking the potential of chart patterns.

3. Identifying support and resistance levels on a price chart

When it comes to technical analysis, one of the fundamental aspects is identifying support and resistance levels on a price chart. These levels play a crucial role in understanding the behavior of an asset’s price movement and can help traders make informed decisions.

Support levels are price levels where buying pressure is expected to be strong enough to prevent the price from falling further. These levels act as a floor for the price, indicating a potential opportunity to buy or enter a long position. Traders often look for areas where the price has previously bounced off multiple times, forming a strong support zone.

On the other hand, resistance levels are price levels where selling pressure is expected to be strong enough to prevent the price from rising further. These levels act as a ceiling for the price, suggesting a potential opportunity to sell or enter a short position. Traders typically look for areas where the price has encountered resistance multiple times, forming a strong resistance zone.

Identifying these levels requires analyzing historical price data and looking for patterns and areas of congestion on the chart. One common approach is to draw horizontal lines at key price levels where the price has previously reversed or stalled. These lines serve as visual representations of support and resistance levels, helping traders visualize the potential areas of interest.

It’s important to note that support and resistance levels are not fixed, but rather dynamic. They can shift over time as the market sentiment and supply-demand dynamics change. Therefore, it’s crucial to regularly update and adjust these levels based on the most recent price action and market conditions.

By mastering the skill of identifying support and resistance levels, traders can gain valuable insights into the potential future price movements of an asset. This knowledge can aid in determining optimal entry and exit points, managing risk, and improving overall trading strategies.

4. The significance of support and resistance in technical analysis

Support and resistance are two crucial concepts in technical analysis that play a significant role in understanding and predicting market trends. These concepts form the foundation of chart patterns and can provide valuable insights into potential price movements.

Support is a price level at which buying pressure exceeds selling pressure, causing the price to “bounce” back up. It acts as a floor for the price, preventing it from falling further. Traders often identify support levels by looking for areas where the price has previously found buying interest and reversed its downward movement. These levels can be seen as opportunities to enter trades or set stop-loss orders.

On the other hand, resistance is a price level at which selling pressure exceeds buying pressure, causing the price to “bounce” back down. It acts as a ceiling for the price, preventing it from rising further. Traders identify resistance levels by observing areas where the price has previously encountered selling pressure and reversed its upward movement. These levels can be seen as potential areas to take profits or initiate short positions.

Understanding the significance of support and resistance levels is essential for technical analysts. They provide valuable information about the supply and demand dynamics in the market. When a support level is breached, it often indicates a shift in sentiment, with selling pressure overpowering buying pressure and potentially leading to further downward movement. Conversely, when a resistance level is broken, it suggests a shift in sentiment, with buying pressure overpowering selling pressure and potentially leading to further upward movement.

Moreover, support and resistance levels can also act as psychological barriers. Traders and investors tend to watch these levels closely, making them self-fulfilling prophecies. If a support or resistance level is widely recognized, market participants may anticipate price reactions around these levels, causing them to act accordingly and reinforcing the significance of these levels in the market.

In conclusion, support and resistance are fundamental concepts in technical analysis that provide valuable insights into market trends and potential price movements. Recognizing and analyzing these levels can enhance a trader’s ability to make informed decisions and effectively navigate the dynamic world of financial markets.

5. Types of support and resistance patterns: horizontal, diagonal, and psychological levels

When it comes to mastering support and resistance in technical analysis, understanding the different types of patterns is crucial. These patterns can help traders identify potential price levels where the market is likely to reverse or experience significant price action.

The first type of support and resistance pattern is the horizontal level. This occurs when the price repeatedly bounces off a specific price level, creating a horizontal line on the chart. These levels can act as strong barriers, as traders tend to pay close attention to them and make their trading decisions based on these levels.

The second type is the diagonal level, also known as trend lines. These patterns are formed by connecting consecutive higher lows or lower highs on the chart. Diagonal levels can provide valuable insight into the strength and direction of the trend. Traders often look for price reactions near trend lines to gauge potential support or resistance areas.

Lastly, psychological levels are another type of support and resistance pattern. These levels are not based on any technical indicators or chart formations but are significant due to the human psychology behind them. Examples of psychological levels include round numbers like $10, $50, or $100. Traders tend to pay attention to these levels, as they often act as strong barriers or attract buying and selling interest.

By understanding these different types of support and resistance patterns, traders can effectively analyze price charts and make informed trading decisions. Whether it’s identifying strong horizontal levels, drawing trend lines, or considering the impact of psychological levels, incorporating these patterns into technical analysis can greatly enhance one’s trading skills and potential for success.

6. Applying support and resistance in trading decisions

Support and resistance are key concepts in technical analysis that can greatly enhance your trading decisions. These levels on a chart represent areas where the price tends to find support as it moves lower or resistance as it moves higher. By understanding and effectively applying support and resistance levels, traders can gain valuable insights into potential entry and exit points for their trades.

Support levels are those price points where buying pressure is strong enough to prevent further downward movement. They act as a floor for the price, providing a level at which traders can expect the demand for an asset to increase and potentially trigger a price reversal or bounce. Resistance levels, on the other hand, are price points where selling pressure becomes significant, preventing further upward movement. They act as a ceiling for the price, indicating a level at which traders can expect the supply for an asset to increase and potentially trigger a price reversal or pullback.

To apply support and resistance in trading decisions, traders often look for confirmation of these levels through various technical analysis tools and indicators. One common approach is to identify key support and resistance levels based on previous price highs and lows, trend lines, or Fibonacci retracement levels. Traders can then use these levels to determine their entry and exit points, setting stop-loss orders just below support levels or just above resistance levels to manage risk.

Moreover, support and resistance can also be used in conjunction with other technical indicators to validate trading signals. For example, if a trader sees a bullish reversal candlestick pattern forming near a strong support level, this could serve as a confirmation for a potential long trade. Conversely, if a bearish reversal candlestick pattern emerges near a significant resistance level, this could provide confirmation for a potential short trade.

It is important to note that support and resistance levels are not fixed, but rather dynamic and subject to market fluctuations. As the price moves and new information comes into play, these levels can shift and evolve. Therefore, it is crucial for traders to regularly update their analysis and adjust their trading decisions accordingly.

By mastering the application of support and resistance in trading decisions, traders can gain a deeper understanding of market dynamics and improve their chances of making profitable trades. These chart patterns provide valuable insights into market sentiment and can serve as reliable tools for identifying potential trading opportunities.

7. Advanced techniques for mastering support and resistance

Once you have a good understanding of the basics of support and resistance levels in technical analysis, you can take your skills to the next level by exploring advanced techniques. These techniques will allow you to further refine your analysis and make more accurate predictions in the market.

One advanced technique is the concept of support becoming resistance and resistance becoming support. This occurs when a price level that previously acted as support is broken, and then later, when the price retraces back to this level, it now acts as a resistance level. Similarly, a previous resistance level that is broken can later act as a support level. This phenomenon is based on the psychology of market participants and can provide valuable insights into future price movements.

Another advanced technique is the use of trend lines in conjunction with support and resistance levels. By drawing trend lines connecting consecutive highs or lows, you can identify the direction and strength of a trend. When these trend lines intersect with support or resistance levels, it adds further confirmation to the importance of those levels. This technique helps you identify potential entry and exit points with a higher degree of confidence.

Additionally, Fibonacci retracement levels can be used in combination with support and resistance levels to pinpoint potential reversal points. The Fibonacci retracement tool is based on a mathematical sequence that identifies key levels of retracement in a trend. When these Fibonacci levels align with support or resistance levels, it indicates a higher probability of a price reversal.

Lastly, understanding volume patterns can provide valuable insights into support and resistance levels. High volume at a support or resistance level suggests that there is significant buying or selling pressure at that level, increasing the likelihood of a price reversal. Analyzing volume can help confirm the strength or weakness of support and resistance levels.

Mastering these advanced techniques for support and resistance analysis takes time, practice, and a deep understanding of market dynamics. By incorporating these techniques into your technical analysis toolkit, you will be better equipped to unlock chart patterns and make more informed trading decisions.

8. Common mistakes to avoid when analyzing support and resistance

Analyzing support and resistance levels is crucial in technical analysis as it helps traders identify potential buying and selling opportunities in the market. However, there are some common mistakes that traders often make when analyzing these levels. By understanding and avoiding these mistakes, you can enhance your chart pattern analysis and make more informed trading decisions.

One common mistake is solely relying on one timeframe for support and resistance analysis. Support and resistance levels can vary across different timeframes, and it is essential to analyze multiple timeframes to get a comprehensive view. By doing so, you can identify significant support and resistance levels that may not be apparent on a single timeframe, improving the accuracy of your analysis.

Another mistake to avoid is disregarding the importance of volume when analyzing support and resistance levels. Volume provides valuable insights into market behavior and can confirm the strength or weakness of support and resistance zones. High volume near a support or resistance level indicates increased buying or selling pressure, adding credibility to the level. Ignoring volume can lead to false breakouts or breakdowns, resulting in poor trading decisions.

Additionally, traders often make the mistake of placing too much emphasis on historical support and resistance levels without considering recent price action. Market dynamics change over time, and older support and resistance levels may lose their significance. It is crucial to incorporate recent price movements and trends to validate the relevance of support and resistance levels in the current market conditions.

Lastly, overcomplicating the analysis by using too many indicators or drawing too many support and resistance lines can be counterproductive. The goal is to keep the analysis simple and focus on the most significant levels that have been tested multiple times. Cluttering the chart with excessive lines and indicators can lead to confusion and may cause traders to miss critical levels or misinterpret price action.

By avoiding these common mistakes, you can improve your ability to analyze support and resistance levels effectively. This, in turn, will enhance your technical analysis skills and help you make more accurate trading decisions based on chart patterns. Stay disciplined, keep learning from your experiences, and refine your approach to master support and resistance analysis in technical analysis.

9. Using support and resistance in conjunction with other technical indicators

Using support and resistance levels in conjunction with other technical indicators can greatly enhance your ability to analyze and interpret chart patterns. While support and resistance alone can provide valuable insights into market trends and potential price reversals, combining them with other indicators can provide a more comprehensive understanding of market dynamics.

One popular indicator to use in combination with support and resistance is the moving average. The moving average helps smooth out price fluctuations and identifies the overall trend direction. By paying attention to where the price is in relation to the moving average, you can gain a clearer picture of whether the market is trending upward or downward.

Another useful indicator to consider is the Relative Strength Index (RSI). The RSI measures the strength and speed of price movements and helps identify overbought or oversold conditions. When combined with support and resistance levels, the RSI can provide confirmation or divergence signals that can help validate potential trading opportunities.

Additionally, incorporating trend lines into your analysis can further enhance your understanding of support and resistance levels. Drawing trend lines connecting significant highs or lows can help identify trend channels and potential breakout points. When these trend lines align with key support or resistance levels, it strengthens their significance and increases the likelihood of a price reaction.

It’s important to note that while combining support and resistance with other technical indicators can be beneficial, it’s crucial to avoid overcomplicating your analysis. Using too many indicators can lead to conflicting signals and confusion. It’s always best to focus on a few key indicators that complement each other and align with your trading strategy.

By utilizing support and resistance levels in conjunction with other technical indicators, you can gain a more comprehensive understanding of chart patterns and make more informed trading decisions. This combination of tools can help you identify potential entry and exit points, manage risk, and improve your overall success in technical analysis.

10. Case studies and real-life examples of successful support and resistance analysis

To truly master support and resistance analysis, it’s essential to delve into case studies and real-life examples. By examining successful instances of these chart patterns in action, you can gain valuable insights and apply them to your own technical analysis.

One notable case study is the support and resistance levels in the stock market during the financial crisis of 2008. As the market plummeted, certain stocks exhibited clear support levels, where the price consistently bounced back from a particular level. Traders who recognized and utilized these support levels were able to enter the market at opportune times, capitalizing on potential rebounds.

Another example is the resistance level seen in the cryptocurrency market during the bull run of 2017. Bitcoin, for instance, encountered strong resistance around the $20,000 mark, with multiple failed attempts to break through this level. Traders who identified and respected this resistance level were able to make informed decisions, such as taking profits or waiting for a significant breakout before entering or exiting positions.

Real-life examples like these provide valuable lessons and demonstrate the practicality of support and resistance analysis. They showcase the importance of identifying key levels and understanding how price reacts to them. By studying these cases, you can enhance your ability to identify support and resistance areas, anticipate potential price movements, and make more informed trading decisions.

It’s worth noting that while case studies offer valuable insights, it’s crucial to remember that past performance does not guarantee future results. Each market and trading scenario is unique, and support and resistance levels may behave differently in varying market conditions. Therefore, it’s essential to combine case study analysis with ongoing research, market analysis, and risk management techniques to create a comprehensive approach to technical analysis.

In summary, studying case studies and real-life examples of successful support and resistance analysis is a fundamental step in mastering this aspect of technical analysis. By learning from past instances, you can improve your ability to identify key levels, make informed trading decisions, and potentially unlock profitable opportunities in the market.

Mastering the Flag and Pennant Pattern in Technical Analysis: A Comprehensive Guide

We hope this blog post on mastering support and resistance has been helpful in unlocking the secrets of chart patterns in technical analysis. Understanding these key concepts is crucial for any trader or investor looking to make informed decisions in the financial markets.

By identifying and interpreting support and resistance levels, you are better equipped to navigate market trends and anticipate potential price movements. Remember to practice and refine your skills through analysis and real-world application. With time and experience, you will become a master at recognizing and utilizing these chart patterns to your advantage. Keep charting, keep analyzing, and keep profiting!

FAQ

How can traders improve their skills in mastering Support and Resistance?

Traders can improve by studying historical charts, practicing identification skills, and using demo accounts to apply theoretical knowledge. Additionally, staying updated on market news, understanding the impact of global events, and continuously refining strategies contribute to mastering Support and Resistance.

Can Support and Resistance levels be applied to different timeframes?

Yes, Support and Resistance are applicable to various timeframes. Short-term traders might focus on intraday levels, while long-term investors may analyze weekly or monthly charts for significant Support and Resistance zones.

How do news events affect Support and Resistance levels?

Major news events can impact Support and Resistance. Strong news can lead to a breakout or breakdown, invalidating previous levels. Traders should be aware of scheduled news releases and economic events that might influence the market.