Candlestick charts have been used for centuries by traders to analyze and predict market trends. Although they may seem confusing at first, once understood, candlestick patterns can provide valuable insights into market behavior. Whether you are a beginner or an experienced trader, understanding candlestick patterns is crucial to success in the stock market.

In this beginner’s guide, we will explain the basics of candlestick patterns, including how to interpret them and how to use them to make informed trading decisions. By the end of this post, you will have a solid understanding of how to read candlestick charts, recognize different patterns, and use them to your advantage in the stock market. Get ready to take your trading skills to the next level with this comprehensive guide to mastering candlestick patterns.

1. Introduction to Candlestick Patterns

Candlestick patterns are a fundamental tool in the world of stock market analysis. Dating back to 18th century Japan, these patterns provide valuable insights into market sentiment and price action. By understanding and mastering candlestick patterns, beginner investors can gain a deeper understanding of market dynamics and make more informed trading decisions.

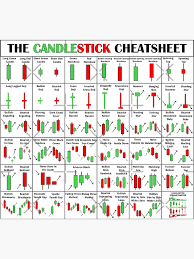

Each candlestick represents the price movement of a specific time period, whether it be a minute, an hour, a day, or longer. The body of the candlestick indicates the opening and closing prices of the stock, while the wicks or shadows show the high and low prices during that period.

Candlestick patterns come in various shapes and sizes, each with its own unique meaning and implications for future price movements. From simple patterns like doji and hammer to more complex formations like engulfing patterns and haramis, learning to recognize and interpret these patterns is essential for any investor looking to navigate the stock market with confidence.

In this beginner’s guide, we will delve into the basics of candlestick patterns, explore common patterns and their significance, and provide tips on how to effectively incorporate this powerful tool into your trading strategy. Stay tuned to unlock the secrets of candlestick patterns and take your stock market success to new heights.

2. Basics of Candlestick Charts

Candlestick charts are a fundamental tool in technical analysis for traders in the stock market. These charts provide a visual representation of price movements over a specific time period, making it easier to identify trends and patterns. Each candlestick on the chart represents the price action for a given period, whether it’s a minute, an hour, a day, or longer.

The basic structure of a candlestick consists of a body and wicks, also known as shadows. The body of the candlestick shows the opening and closing prices for the period, with different colors indicating whether the price increased or decreased during that time. A bullish candle, where the closing price is higher than the opening price, is typically represented in green or white. Conversely, a bearish candle, where the closing price is lower than the opening price, is usually displayed in red or black.

The length of the wicks represents the high and low prices reached within the period. A long upper wick indicates that the price rose significantly before closing lower, while a long lower wick signals a sharp decline followed by a rebound. Understanding these components and their variations is essential for interpreting candlestick patterns accurately and making informed trading decisions.

3. Understanding the Anatomy of a Candlestick

Understanding the anatomy of a candlestick is crucial for interpreting price movements in the stock market. Each candlestick provides valuable information about the trading activity during a specific time period, whether it be a minute, an hour, a day, or longer.

The basic components of a candlestick include the body and the wicks/shadows. The body of the candlestick represents the opening and closing prices of the stock during the specified time period. If the closing price is higher than the opening price, the body is typically colored green or white to indicate a bullish movement. Conversely, if the closing price is lower than the opening price, the body is usually colored red or black to signify a bearish movement.

The wicks/shadows of the candlestick extend from the top and bottom of the body and represent the high and low prices reached during the time period. These wicks provide additional insight into the price action, showing the range of trading and the levels of volatility within the market.

By analyzing the size, shape, and color of candlesticks, traders can identify patterns and trends that may help predict future price movements. Mastering the interpretation of candlestick patterns is a fundamental skill that can greatly enhance your success in the stock market.

4. Common Candlestick Patterns for Beginners

In the world of stock market trading, understanding candlestick patterns is essential for making informed decisions and achieving success. For beginners, learning about common candlestick patterns can provide valuable insights into market trends and potential price movements.

One of the most basic candlestick patterns is the Doji, which signifies market indecision and potential reversal. The Hammer and Hanging Man patterns indicate potential bearish or bullish reversals, depending on their context within the price chart. Engulfing patterns, such as the Bullish Engulfing and Bearish Engulfing patterns, signal potential trend reversals.

Another common pattern is the Morning Star and Evening Star patterns, which indicate potential trend reversals after a period of consolidation. The Shooting Star and Inverted Hammer patterns also provide insights into potential reversals, depending on their placement within the price chart.

By familiarizing yourself with these common candlestick patterns, beginners can start to interpret market sentiment and make more informed trading decisions. It’s important to practice recognizing these patterns in real-time charts to gain confidence in applying them to your trading strategy.

5. Bullish Patterns and Their Significance

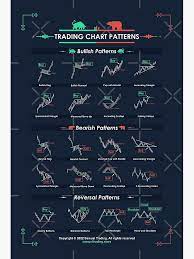

Bullish candlestick patterns are essential tools for any trader looking to identify potential upward trends in the stock market. These patterns can provide valuable insights into market sentiment and help traders make informed decisions when entering or exiting positions.

One of the most common bullish patterns is the “Hammer,” which consists of a small body at the top of a long lower shadow. This pattern indicates that sellers tried to push the price lower but were ultimately unsuccessful, signaling a potential reversal to the upside.

Another bullish pattern to watch for is the “Bullish Engulfing Pattern,” where a smaller bearish candle is followed by a larger bullish candle that completely engulfs the previous candle’s body. This pattern suggests a shift from bearish to bullish sentiment and often precedes a price increase.

Understanding the significance of bullish candlestick patterns can give traders a competitive edge in the stock market. By recognizing these patterns and their implications, traders can make more strategic decisions that align with market trends and potentially increase their chances of success.

6. Bearish Patterns and What They Indicate

Bearish candlestick patterns can provide valuable insights for traders looking to navigate the stock market. These patterns signal potential downward trends in stock prices, offering an opportunity for traders to make informed decisions on when to sell or short a stock. Understanding bearish patterns is crucial for managing risk and maximizing profits in the stock market.

One common bearish pattern is the “Bearish Engulfing Pattern,” where a large bearish candle completely engulfs the previous smaller bullish candle. This pattern suggests a potential reversal of an uptrend, indicating that selling pressure may outweigh buying pressure in the market.

Another bearish pattern to watch for is the “Evening Star Pattern,” which consists of three candles – a large bullish candle, followed by a small-bodied candle or doji, and finally, a large bearish candle. This pattern signifies a potential trend reversal from bullish to bearish, as the market sentiment shifts from optimism to pessimism.

Additionally, the “Dark Cloud Cover Pattern” is a bearish signal that occurs when a large bullish candle is followed by a bearish candle that opens above the previous day’s high and closes near the middle of the first candle’s body. This pattern suggests a potential reversal in an uptrend, as selling pressure increases and could lead to a downturn in stock prices.

By recognizing and understanding these bearish candlestick patterns, beginner traders can enhance their technical analysis skills and make more informed trading decisions. It is essential to combine candlestick patterns with other technical indicators and risk management strategies to develop a comprehensive trading plan for success in the stock market.

7. Reversal Patterns vs. Continuation Patterns

Understanding the difference between reversal patterns and continuation patterns is crucial for successful trading in the stock market. Reversal patterns indicate a potential change in the current trend, signaling that the price may reverse its direction. These patterns can help traders identify when a downtrend may be turning into an uptrend or vice versa, providing valuable insights for making informed trading decisions.

On the other hand, continuation patterns suggest that the current trend is likely to persist after a brief pause or consolidation. Recognizing these patterns can help traders anticipate the resumption of the prevailing trend and position themselves accordingly to capitalize on the price movement.

By mastering both reversal and continuation patterns, beginner traders can enhance their ability to analyze stock charts effectively and make more informed decisions when buying or selling stocks. Developing a keen eye for these patterns and understanding their implications can significantly improve trading success and profitability in the stock market.

8. Using Candlestick Patterns for Entry and Exit Points

When it comes to trading in the stock market, mastering candlestick patterns can be a game-changer for beginners. Understanding how to use candlestick patterns for entry and exit points is crucial for making informed decisions and maximizing profitability.

Candlestick patterns provide valuable insights into market sentiment and price action. By recognizing specific patterns, traders can anticipate potential market reversals or continuations. For example, a bullish engulfing pattern signals a potential trend reversal to the upside, while a bearish harami suggests a possible reversal to the downside.

For entry points, traders can look for specific candlestick patterns that indicate a favorable risk-to-reward ratio. For instance, a hammer pattern at a key support level may signal a buying opportunity, while a shooting star at a resistance level could indicate a potential short-selling opportunity.

When it comes to exit points, traders can use candlestick patterns to determine when to take profits or cut losses. For example, a doji pattern after a strong uptrend may signal indecision in the market and prompt traders to consider closing their long positions.

Overall, mastering candlestick patterns for entry and exit points requires practice, patience, and a keen eye for detail. By incorporating these patterns into your trading strategy, you can enhance your decision-making process and increase your chances of stock market success.

9. Tips for Mastering Candlestick Patterns

Mastering candlestick patterns is a crucial skill for anyone looking to achieve success in the stock market. These patterns offer valuable insights into market sentiment and can help traders make informed decisions about when to buy or sell stocks. Here are some tips to help you master candlestick patterns:

1. **Study and Practice**:

Understanding candlestick patterns requires time and dedication. Study the different types of patterns and their meanings. Practice analyzing historical stock charts to familiarize yourself with how these patterns appear in real-life trading scenarios.

2. **Focus on Key Patterns**:

While there are numerous candlestick patterns, focus on mastering the most common and reliable ones first. Patterns like Doji, Hammer, Shooting Star, and Engulfing Patterns are essential to grasp as they often signal significant market movements.

3. **Combine with Technical Analysis**:

Candlestick patterns are most effective when used in conjunction with other technical analysis tools. Incorporate indicators like moving averages, RSI, and MACD to confirm signals provided by candlestick patterns.

4. **Consider Timeframes**:

Candlestick patterns can vary in significance depending on the timeframe being analyzed. Be mindful of the timeframe you are trading in and adjust your analysis accordingly.

5. **Stay Updated**:

Market conditions are always evolving, and new patterns may emerge over time. Stay updated with market news and trends to adapt your candlestick analysis to current market dynamics.

By following these tips and continuously honing your skills, you can enhance your ability to interpret candlestick patterns effectively and make informed trading decisions in the stock market.

10. Real-Life Examples of Candlestick Patterns in Stock Trading

Real-life examples of candlestick patterns in stock trading can provide invaluable insights for beginners looking to master this aspect of technical analysis. Let’s consider a common candlestick pattern known as the “Hammer.”

Imagine you are analyzing the stock chart of a company and notice a hammer pattern forming after a downtrend. The hammer consists of a small body at the top of the candlestick with a long lower shadow, indicating that sellers drove prices lower during the trading session, but buyers managed to push the price back up by the close.

In this scenario, the hammer suggests a potential reversal in the stock’s price direction. Traders often see this pattern as a signal to go long on the stock, anticipating a bullish movement in the near future.

Another example is the “Doji” candlestick pattern, characterized by a candle with almost no body and long wicks on both ends. A Doji signifies indecision in the market, with neither buyers nor sellers able to establish control. When a Doji forms after a strong uptrend or downtrend, it can indicate a potential reversal.

By studying and recognizing these candlestick patterns in real-life stock charts, beginner traders can gain a deeper understanding of market dynamics and improve their ability to make informed trading decisions. Practice identifying these patterns on historical and real-time stock charts to enhance your skills in technical analysis and increase your chances of success in the stock market.

11. Importance of Practice and Patience

To truly master candlestick patterns and achieve success in the stock market, it is crucial to understand the importance of practice and patience. Learning to interpret and utilize these patterns effectively takes time and dedication.

Practice is key when it comes to honing your skills in recognizing and analyzing candlestick patterns. Regularly studying charts, identifying different patterns, and observing how the market reacts to them will help you gain a deeper understanding of their significance. By practicing consistently, you will become more adept at interpreting these patterns and making informed trading decisions.

In addition to practice, patience is a virtue that all successful stock market traders possess. It’s essential to exercise patience when waiting for the right opportunities to present themselves based on the candlestick patterns you have identified. Rushing into trades without proper analysis can lead to costly mistakes. By exercising patience and waiting for the ideal setups, you increase your chances of making profitable trades.

Remember, mastering candlestick patterns is a journey that requires dedication, practice, and patience. By committing to continuous learning and honing your skills, you can enhance your stock market success and achieve your trading goals.

12. Conclusion: Empowering Yourself with Candlestick Patterns

In conclusion, mastering candlestick patterns can be a powerful tool in your arsenal as you navigate the complex world of the stock market. By understanding the various patterns and what they signify, you empower yourself to make more informed trading decisions.

Candlestick patterns offer valuable insights into market sentiment, helping you anticipate potential price movements and identify high-probability trading opportunities. Whether you are a beginner or an experienced trader, incorporating candlestick analysis into your trading strategy can enhance your overall success.

Remember, practice and patience are key when learning to interpret candlestick patterns. Take the time to study and familiarize yourself with the different patterns, and consider incorporating them into your trading routine gradually.

By equipping yourself with knowledge and skills in candlestick analysis, you can gain a deeper understanding of market dynamics and improve your ability to time your trades effectively. Empower yourself with candlestick patterns, and embark on your journey towards stock market success with confidence and clarity.

Mastering Wedge Patterns: Unveiling the Secrets of Rising and Falling Wedges in Technical Analysis

We hope this beginner’s guide to mastering candlestick patterns has provided you with valuable insights into the world of stock market trading. By understanding and utilizing these patterns effectively, you can make more informed decisions and potentially achieve greater success in your trading endeavors. Remember, practice makes perfect, so take the time to familiarize yourself with these patterns and hone your skills. Here’s to your future success in the stock market!

FAQ

How can traders implement candlestick patterns in their trading strategies?

Traders can use candlestick patterns to identify potential entry and exit points for trades. For example, a Bullish Engulfing pattern might signal a potential uptrend.

Are there any risks associated with relying solely on candlestick patterns?

Yes, relying solely on candlestick patterns can be risky, as no pattern guarantees a specific outcome. It's important to consider other factors and use patterns as one of several tools in your analysis.