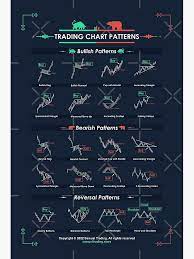

Technical analysis is a common approach that investors use to try to predict future movements in the stock market. Chart patterns, in particular, are a popular tool that traders use to analyze the price history of a stock. One of the most significant chart patterns is the triple top and triple bottom patterns. These patterns are a crucial part of technical analysis and can be used to identify potential changes in the stock’s direction.

The triple top pattern is a bearish reversal pattern, while the triple bottom pattern is a bullish reversal pattern. In this post, we will explore the triple top and triple bottom chart patterns in detail. We will analyze how these patterns develop, what they mean, and how traders can use them to make better investment decisions. So, get ready to crack the code of triple top and triple bottom patterns and take your stock trading to the next level!

1. Introduction to chart patterns Triple Top and Triple Bottom in stock technical analysis

When it comes to stock technical analysis, chart patterns play a crucial role in predicting future price movements. These patterns are formed by the price action of a stock over a period of time and can provide valuable insights into market trends and potential trading opportunities.

One such set of chart patterns that traders often look out for are the triple top and triple bottom patterns. These patterns are characterized by the repeated testing of a specific price level, creating a distinct formation on the stock chart.

A triple top pattern occurs when the price of a stock reaches a resistance level three times, but fails to break above it. This signals a potential reversal in the upward trend and suggests that the stock may be losing its bullish momentum. On the other hand, a triple bottom pattern is formed when the price of a stock tests a support level three times, but fails to break below it. This indicates a potential reversal in the downward trend and suggests that the stock may be gaining bullish momentum.

By recognizing and understanding these chart patterns, traders can gain insights into the psychology of market participants. The repeated rejections at a particular level in the case of a triple top pattern may indicate that buyers are losing interest and sellers are gaining control. Conversely, the repeated bounces off a support level in a triple bottom pattern may suggest that sellers are losing momentum and buyers are stepping in.

It is important to note that chart patterns should not be relied upon solely for making trading decisions. They should be used in conjunction with other technical indicators and analysis tools to increase the probability of success. Additionally, it is crucial to consider other factors such as market conditions, news events, and overall trend before making any trades based on chart patterns.

In this blog series, we will delve deeper into the intricacies of triple top and triple bottom patterns, exploring their characteristics, significance, and strategies for trading them effectively. By deciphering the secrets of these chart patterns, traders can enhance their technical analysis skills and potentially uncover profitable trading opportunities in the stock market.

2. Understanding the basics: What are triple top and triple bottom chart patterns?

Before diving into the intricacies of triple top and triple bottom chart patterns, it’s crucial to understand the basics of these formations.

Triple top and triple bottom chart patterns are powerful tools used in technical analysis to predict future price movements in the stock market. These patterns are characterized by three consecutive peaks or valleys, respectively, forming on a price chart.

In the case of a triple top pattern, it indicates a potential reversal of an uptrend. Traders and investors observe three consecutive peaks that reach a similar resistance level, creating a horizontal line. This resistance level acts as a significant barrier that prevents the stock price from further upward movement. It suggests that buyers are unable to push the price higher, and sellers may take control, leading to a potential trend reversal.

On the other hand, a triple bottom pattern indicates a potential reversal of a downtrend. Traders and analysts identify three consecutive valleys, forming a horizontal support level. This support level acts as a strong floor, preventing the stock price from falling further. It suggests that sellers are unable to push the price lower, and buyers may start entering the market, leading to a potential trend reversal.

Both triple top and triple bottom chart patterns are considered significant because they signify a battle between buyers and sellers at key levels. The formation of these patterns indicates a period of indecision in the market, where the stock price struggles to break through a particular price level.

By recognizing and understanding these patterns, traders can anticipate potential trend reversals and adjust their trading strategies accordingly. However, it’s essential to combine these patterns with other indicators and confirmatory signals to increase the accuracy of predictions and minimize risks.

In the upcoming sections, we will delve deeper into the intricacies of triple top and triple bottom chart patterns, exploring their characteristics, trading strategies, and real-life examples to equip you with the knowledge necessary to crack the code of these powerful tools in stock technical analysis.

3. Identifying triple top chart patterns: Characteristics and formation

Identifying triple top chart patterns is a critical skill for any technical analyst. These patterns can provide valuable insights into potential reversals or trend continuations in stock prices. Understanding the characteristics and formation of triple top patterns is essential to effectively use them in your analysis.

A triple top pattern is formed when the price of a stock reaches a resistance level three times without being able to break above it. The resistance level acts as a barrier, preventing further upward movement in the stock’s price. Each time the price reaches this level, it experiences a reversal or pullback, signaling a potential trend change.

To identify a triple top pattern, look for three distinct peaks in the stock’s price chart, all occurring at or near the same resistance level. These peaks should be relatively equal in height, indicating that buyers are unable to push the price higher.

Additionally, the time duration between each peak is an important factor to consider. Ideally, the peaks should be formed within a similar time frame, suggesting that the resistance level is strong and consistent.

It’s worth noting that volume analysis can provide additional confirmation of the pattern’s validity. Typically, as the stock approaches the resistance level for the third time, volume tends to decrease, indicating a lack of buying interest and weakening momentum. This divergence between price and volume can further support the presence of a triple top pattern.

Once a triple top pattern is identified, traders often look for a break below a key support level as a confirmation of a bearish reversal. This breakdown suggests that selling pressure has overcome buying interest, potentially leading to a significant price decline.

In conclusion, identifying triple top chart patterns involves recognizing the key characteristics of three distinct peaks at a resistance level, preferably formed within a similar time frame. Combining this analysis with volume confirmation can strengthen your trading decisions and help you uncover the secrets of this powerful chart pattern in stock technical analysis.

4. Analyzing triple top chart patterns: Psychological insights and market sentiment

Analyzing triple top chart patterns goes beyond just observing the technical aspects of the pattern. It also involves delving into the psychological insights and market sentiment behind these formations. By understanding the underlying factors influencing market participants, you can gain valuable insights into potential price movements and make more informed trading decisions.

Triple top chart patterns typically indicate a significant resistance level that the stock price struggles to break through on three separate occasions. This resistance level often represents a psychological barrier for traders and investors alike. It signifies a point where selling pressure becomes dominant, preventing further upward momentum.

From a psychological perspective, triple top patterns can reflect market indecision and uncertainty. As the price approaches the resistance level for the third time, investors who previously bought the stock may start questioning its potential for further gains. This hesitation can lead to increased selling activity, resulting in a reversal of the previous upward trend.

Market sentiment is another crucial factor to consider when analyzing triple top patterns. Sentiment refers to the overall attitude and outlook of market participants towards a particular stock or the market as a whole. In the case of triple top formations, negative sentiment can play a significant role in the pattern’s development.

If market sentiment is bearish or there are negative external factors affecting the stock or the broader market, it can amplify the selling pressure at the resistance level. Traders and investors may perceive the stock as overvalued or lacking the catalysts necessary to drive further price appreciation. This skepticism can contribute to the failure to break through the resistance level and the subsequent downtrend that follows.

By considering the psychological insights and market sentiment surrounding triple top chart patterns, you can better understand the dynamics at play and potentially anticipate future price movements. It is important to combine technical analysis with these additional layers of analysis to enhance your trading strategy and increase your chances of success in the stock market.

5. Interpreting triple top chart patterns: Implications for trend reversal or continuation

Interpreting triple top chart patterns is a crucial skill for any trader or investor engaged in stock technical analysis. These patterns often indicate a potential trend reversal or continuation, providing valuable insights into the future direction of a stock’s price.

A triple top pattern is formed when a stock price reaches a specific resistance level three times, failing to break above it each time. This repeated failure signifies a strong resistance zone that can signal a potential reversal in the prevailing upward trend.

When observing a triple top pattern, it is essential to analyze the volume of trading accompanying each failed attempt to break above the resistance level. If the volume diminishes with each subsequent attempt, it suggests a weakening buying pressure and increasing selling pressure, further strengthening the bearish implications of the pattern.

Additionally, the time duration of the pattern’s formation can provide further insights. If the three tops are formed relatively close to each other, it indicates a more immediate reversal in the stock’s trend. On the other hand, if the tops are spread out over an extended period, it suggests a more gradual trend reversal.

Traders and investors should also pay attention to other technical indicators such as moving averages, oscillators, and support levels when interpreting triple top patterns. A confirmation of the pattern through these indicators can increase the confidence in predicting a trend reversal.

However, it is crucial to exercise caution when relying solely on triple top patterns as they are not infallible. It is advisable to combine them with other technical analysis tools and indicators to strengthen the overall analysis and decision-making process.

In conclusion, understanding and interpreting triple top chart patterns can provide valuable insights into potential trend reversals or continuations in stock technical analysis. By analyzing factors such as volume, time duration, and other technical indicators, traders and investors can enhance their ability to make informed decisions and navigate the dynamic world of stock markets effectively.

6. Case studies: Real-life examples of triple top chart patterns in stock charts

To truly understand and master the art of technical analysis, it is crucial to analyze real-life examples of chart patterns. In this section, we will delve into case studies of triple top chart patterns in stock charts, providing you with insights into how this pattern can be identified and utilized in your trading strategy.

Case Study 1: Company XYZ

Let’s start with a recent example of a triple top chart pattern observed in the stock of Company XYZ. Over a period of several months, the stock price reached a resistance level at around $50, unable to break through. This resistance level acted as the first top of the triple top pattern.

After the initial failed attempt to breach the resistance, the stock price retraced before making a second attempt. Once again, it faced significant selling pressure near the $50 mark, forming the second top. At this point, traders and investors who follow technical analysis principles would have started to take notice of this potential triple top pattern.

As time progressed, the stock price rallied once more, approaching the resistance level for the third time. However, similar to the previous two attempts, it failed to surpass the $50 mark, witnessing a sharp reversal and forming the third top. This confirmed the presence of a triple top chart pattern.

Following the completion of the pattern, traders who recognized this formation would have anticipated a bearish trend reversal. The break below the support level, typically located at the swing low between the tops, would be considered a significant sell signal.

Case Study 2: Sector ETF

Now, let’s explore a different case study involving a sector ETF. In this scenario, the ETF had been in a prolonged uptrend, with multiple attempts to break above a key resistance level near $100. Each time the price reached this level, it reversed, forming a series of tops.

As the pattern unfolded, traders who were familiar with the triple top chart pattern recognized the significance of the price failing to break above the resistance level. This provided a valuable opportunity to consider a potential short position or exiting long positions.

It is essential to note that while triple top patterns can provide valuable insights, they are not foolproof indicators. It is crucial to combine technical analysis with other tools and indicators to validate the confirmation of such patterns and make well-informed trading decisions.

By studying real-life examples of triple top chart patterns, you can enhance your understanding of this pattern’s characteristics, improve your ability to identify it in stock charts, and effectively incorporate it into your trading strategy. Remember, practice and continuous learning are key to cracking the code of technical analysis and unlocking profitable trading opportunities.

7. Strategies for trading triple top chart patterns: Entry and exit points, stop-loss levels

Trading triple top chart patterns requires careful analysis and strategic decision-making. Identifying entry and exit points, as well as setting appropriate stop-loss levels, are crucial aspects of maximizing profit and minimizing potential losses.

When trading triple top patterns, the entry point is typically established once the price breaks below the support level formed by the previous two lows. This breakdown confirms the reversal of the bullish trend and signals a potential downward movement. Traders often wait for a clear break below the support level before entering a short position.

To determine the exit point, traders can utilize various techniques. One common approach is to measure the distance between the top of the pattern and the support level, and then project that distance downwards from the breakout point. This projection gives an approximate target for the price decline. Additionally, traders may choose to exit the trade when the price reaches a significant support level or when other technical indicators suggest a potential trend reversal.

Setting stop-loss levels is essential for managing risk in trading. Traders can place their stop-loss orders slightly above the triple top pattern’s resistance level to protect against potential false breakouts. By doing so, they can limit their losses in case the price unexpectedly reverses and breaks above the resistance level.

It is important to note that no trading strategy is foolproof, and careful monitoring of price movements and market conditions is crucial. Traders should also consider incorporating other technical indicators, such as volume analysis or oscillators, to validate the signals provided by the triple top chart pattern.

Remember, successful trading requires practice, patience, and continuous learning. Implementing proper risk management techniques and staying disciplined in executing your trading plan will increase your chances of achieving consistent profits when trading triple top chart patterns.

8. Pitfalls and challenges: False signals and how to avoid them

While triple top and triple bottom chart patterns can be powerful indicators in stock technical analysis, it is important to be aware of the potential pitfalls and challenges associated with these patterns. One common challenge is the occurrence of false signals, where the pattern may initially appear to be forming but fails to materialize into a significant price movement.

False signals can mislead traders and result in poor trading decisions. To avoid falling into this trap, it is crucial to exercise caution and implement certain strategies.

Firstly, it is essential to wait for confirmation before taking any action. This means not jumping the gun and prematurely assuming that a triple top or triple bottom pattern is forming. Instead, patiently observe the price action and wait for the pattern to fully develop and confirm itself.

Secondly, it is vital to consider other technical indicators and factors that can validate or invalidate the pattern. This includes analyzing volume levels, trend lines, and other chart patterns that may be present. By considering multiple indicators, you can gain a more comprehensive understanding of the market dynamics and increase your confidence in the pattern.

Furthermore, it is advisable to use stop-loss orders to manage risk. Placing a stop-loss order below the support level in the case of a triple top pattern or above the resistance level in the case of a triple bottom pattern can help mitigate potential losses if the pattern fails.

Lastly, continuously honing your skills and knowledge in technical analysis can significantly enhance your ability to identify and avoid false signals. Stay updated with market trends, study historical chart patterns, and learn from experienced traders to refine your analysis techniques.

By being mindful of these pitfalls and implementing the necessary precautions, you can navigate the complexities of triple top and triple bottom chart patterns with greater accuracy and confidence in your stock trading endeavors.

9. Triple bottom chart patterns: Similarities and differences compared to triple top patterns

Understanding the similarities and differences between triple bottom and triple top chart patterns is crucial for any investor or trader looking to make informed decisions in the stock market.

Both triple bottom and triple top patterns are reversal patterns commonly used in technical analysis.

While triple top patterns signify a potential trend reversal from bullish to bearish, triple bottom patterns indicate a shift from bearish to bullish. These patterns are formed when the price of a stock reaches a particular level three times before reversing its direction.

One similarity between these patterns is that they both indicate a period of indecision in the market. During the formation of a triple top pattern, buyers struggle to push the stock price higher, resulting in a resistance level being established. Conversely, during the formation of a triple bottom pattern, sellers find it difficult to push the price lower, creating a support level.

Another similarity is the significance of the neckline, which is the horizontal line connecting the highs or lows of the pattern. The neckline acts as a confirmation level for both patterns. When the price breaks below the neckline of a triple top pattern, it suggests a bearish trend continuation. On the other hand, when the price breaks above the neckline of a triple bottom pattern, it indicates a bullish trend continuation.

Despite these similarities, there are also notable differences between triple top and triple bottom patterns. One key difference lies in the psychological aspect of market participants. Triple top patterns often occur when buyers become exhausted, leading to a reversal in the stock’s direction. In contrast, triple bottom patterns form when sellers lose momentum and buyers regain control, indicating a potential trend reversal.

Additionally, the volume characteristics of these patterns differ. In triple top patterns, the volume tends to decrease as the price approaches each subsequent peak, suggesting a lack of buying interest. Conversely, in triple bottom patterns, the volume typically increases as the price approaches each subsequent low, indicating increased buying activity.

Understanding the similarities and differences between triple bottom and triple top patterns can give traders and investors an edge in identifying potential trend reversals. By analyzing these patterns and considering other technical indicators, market participants can make more informed decisions and potentially profit from market movements.

10. Conclusion: Incorporating triple top and triple bottom chart patterns into your trading strategy.

Incorporating triple top and triple bottom chart patterns into your trading strategy can be a game-changer. These patterns provide valuable insights into potential market reversals, allowing traders to take advantage of profitable opportunities.

By understanding the characteristics and implications of triple top and triple bottom patterns, traders can make informed decisions and enhance their overall trading success. These patterns signify a significant shift in market sentiment, indicating a potential trend reversal.

When incorporating these patterns into your trading strategy, it is crucial to consider other technical indicators and factors such as volume, trend lines, and support and resistance levels. This comprehensive analysis can help confirm the validity of the pattern and increase the probability of a successful trade.

Additionally, it is essential to set clear entry and exit points, as well as establish appropriate risk management measures. This ensures that traders are prepared for potential fluctuations and can minimize losses if the pattern fails to hold.

Remember, successful trading requires discipline, patience, and continuous learning. It is crucial to practice proper risk management and thoroughly analyze market conditions before executing any trades based on triple top and triple bottom chart patterns.

In conclusion, incorporating triple top and triple bottom chart patterns into your trading strategy can provide valuable insights and enhance your trading performance. By combining these patterns with other technical analysis tools and implementing sound risk management practices, traders can increase their chances of success in the dynamic world of stock trading.

Mastering Support and Resistance: Unlocking Chart Patterns in Technical Analysis

We hope you found our blog post on triple top and triple bottom chart patterns in stock technical analysis informative and valuable. Understanding these patterns can provide valuable insights into the future direction of a stock’s price movement.

By recognizing and interpreting these patterns, you can make more informed investment decisions and potentially capitalize on profitable trading opportunities. Remember to apply proper risk management strategies and consult with a financial advisor before making any investment decisions. Happy chart analyzing!

FAQ

Where can I learn more about triple top and triple bottom patterns?

There are numerous resources available for learning about triple top and triple bottom patterns, including books, online courses, forums, and educational websites dedicated to technical analysis. Additionally, traders can gain practical experience by analyzing historical price charts and practicing simulated trading before applying these patterns in live markets.

Can triple top and triple bottom patterns be applied to different financial markets?

Yes, triple top and triple bottom patterns can be applied to various financial markets, including stocks, forex, commodities, and cryptocurrencies. However, traders should consider market-specific factors such as trading hours, liquidity, and volatility when analyzing these patterns in different markets.

How reliable are triple top and triple bottom patterns?

While triple top and triple bottom patterns can provide valuable insights into potential trend reversals, their reliability depends on various factors such as the timeframe, volume, and market conditions. Traders often combine these patterns with other technical indicators or confirmation signals to increase their accuracy. Additionally, false signals can occur, so it's essential to exercise caution and use proper risk management techniques when trading based on these patterns.